Want to know how to turn $10,000 into $1,000,000?

Well, I recently read a book on this very topic. Christopher Mayer’s book, describes the key factors to finding stocks that can grow 100 times in value. In the book, Chris outlines several things such as case studies on 100 baggers, criteria for determining 100-baggers and more.

I’m going break down the lessons that I learned from this book to help you find that next 100-bagger. The key here is that it doesn’t take an Economics professor to use this criteria to narrow down potential investments; it is more a question of applying that criteria and then acting upon that conviction. But Chris does dedicate almost 2 entire chapters of the book to a very important aspect of this process: your patience.

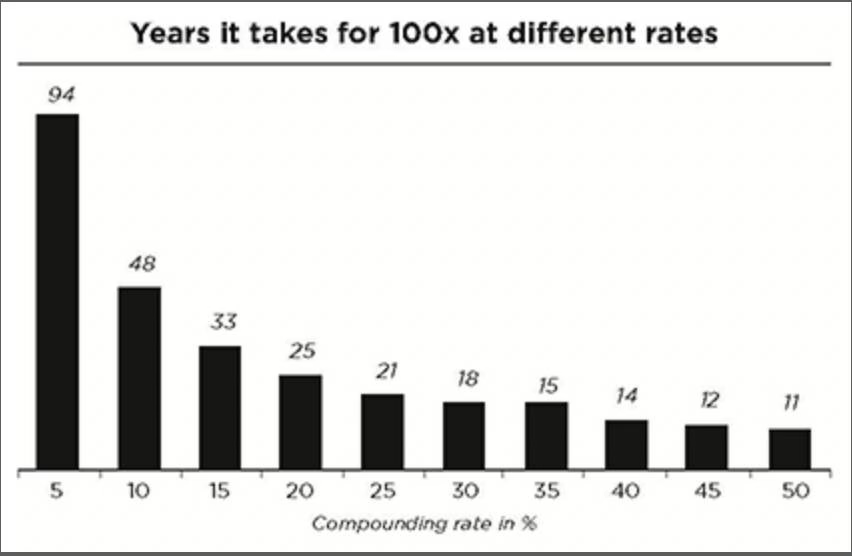

100-baggers often take years, even decades, to reach their full potential. The real challenge isn’t picking them—it’s holding onto them for the long haul. You need to be patient and disciplined. Emotional reactions to market ups and downs can prevent you from realizing massive gains. Stick to your plan and let your investments grow. Chris equates it to the “coffee-can” portfolio which you may or may not be familiar with. Basically it is layman way of saying holding an investment for many years, a set it and forget it style to investing.

So if you are willing to wait for a good investment to materialize, then let’s get into it.

First off, what is a 100-bagger?

A “100-bagger” is a stock that grows 100 times in value. This means a $100 investment becomes $10,000, a $1000 investment becomes $100,000, and a $10,000 investment turns into $1,000,000 in a given amount of time. These are rare but not impossible investments. Mayer studied the stocks that hit this milestone and shared insights on how you and I can find them too.

The key factor to 100-baggers

There are a variety of traits in a stock that has gone on to return 100x returns which I will describe, but without burying the lead, the most important thing to look for is consistent and high return on equity (ROE). ROE is a measure of what return a business can generate from the equity invested back into the business. So if you invested $100 and made $15 on that in a year, you would have made a 15% ROE.

Mayer’s and other’s research and study into 100-baggers has shown that those 100 baggers had high ROE percentages year over year. And it makes sense when you think about it, a company has to be great allocators and stewards of invested capital. Without question, if a management team cannot do this then the stock will not likely be a 100-bagger.

In addition, you have to be wary of the source of high ROE, as stock buybacks and other things can artificially increase the ROE, but cannot replace a long run of high ROE years. I’ll talk about stock buybacks in a bit, but stocks doing buybacks with no sales growth tend to have multiple contraction at the same time which is not great for finding 100-baggers.

Other common traits of 100-baggers

Let’s quickly list the other traits that produce such returns and then dive more deeply. 100-baggers have several common traits besides high consistent ROE listed below.

- Low multiples

- Stock buybacks

- Owner-operation

- Competitive moat

- Betting big

- Small marketcap

Low multiples

It should go without saying, but if you pay a million dollars to buy a rental property that is only really worth $500,000, you probably are not going to make any return on your investment for the foreseeable future, let alone a 100x. The idea here is the same; you need to get potential 100-baggers at the right price otherwise it will eat into your returns the higher you pay.

The thing is multiples are tricky as you may pay even 50 times earnings or higher and still get a bargain. There are various factors that play into price to earnings ratios and you can’t just pick the lowest P/E stocks and go with that. Oftentimes those stocks are priced that way for a reason. As these lessons are for the long-term investor, paying slightly higher than normal for a high quality/high ROE company with all the factors listed in this article could be worth it.

Stock buybacks

As mentioned earlier, stock buybacks can be a tool of great power to boost ROE but done at the wrong valuation and/or in low-growth scenarios, and they can range from pointless to value-trapping. Nevertheless, stock buybacks combined with high ROE and low multiples and you have a recipe for a rocket ship.

Warren Buffett advised his shareholders that stock buybacks are only appropriate in one combination: when the company has available funds to do the stocks buybacks without hampering their operations and when the company finds their stock below it’s intrinsic value when conservatively calculated.

Owner-operation

I believe that companies that continue to operate with the original founders are a step ahead of companies with outsiders. There have skin in the game and were there when the company was at it’s lowest point all the way up to the highest successes. It is this drive, this ambition, that drives owner CEOs to outperform day in and day out and show up to work. We have seen recent examples of how companies fall down when their founders are distracted such as Elon Musk with DOGE. Tesla shares have suffered huge declines in part to due to the lack of clarity with their headliner CEO.

Management teams that place investors in great regard and treat them as partners in the business should be highlighted and their businesses researched more thoroughly as potentials for multi-baggers. These teams understand that returning capital to investors at the most effectives times is optimal for their business as well as the shareholders.

Competitive moat

100-bagger stocks require a relatively long time to compound invested capital which makes company moats essential. If the high ROE of a company is lowered through competition, it can no longer compound the invested capital as efficiently as the sheer amount of money it reinvests may go down. In addition, companies in highly competitive industries or cyclical industries will have to “fight” to stay competitive, i.e. – they will have to spend more of their cash on operations and things that do compound reinvested capital.

Betting big

Would you make life-changing money if you found a 100-bagger and invested $1 into it? No, you would not and you would probably feel good and bad about it. Good that all the hard work and research to find a 100-bagger was fruitful and then bad for making a $100 for your effort. This in a nutshell is the principal of betting big and holding to your conviction; basically buying right and holding on. As the late Charlie Munger stated, “If a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result”.

The research you do on these stocks should yield high quality stocks that provide consistent and pervasive ROE for years, so you should not discount your own investment in them, not by conviction and definitely not by your wallet.

Small marketcap

The law of large numbers states that as a company grows, it becomes more difficult to sustain its previous growth rates. With marketcaps of companies reaching trillions of dollars, certain companies are just too large to be good candidates for 100-baggers. For example, Apple has a marketcap of $2.97 trillion as of writing and for it to 100x it would need to go to $297 trillion with everything else constant! Clearly making sure that you are investing in a company that has a good chance to 100x is an integral part of picking great investments.

Conclusion

It’s not about short-term gains—it’s about finding businesses that can return high ROE for multiple years with all or most of the factors above. Once you find a stock that checks all these boxes, make sure you read their annual reports, earnings statements, guidance and more in order to give yourself the best possible chance to snag a 100-bagger in your lifetime.

I hope this has given you some insights on finding that 100-bagger stock, please considering contributing to my blog and/or subscribing to my YouTube where I discuss things like this!

Disclosure – I do not own any shares in any of the companies mentioned. Please do your own due diligence before buying any investment. This article and this website are not financial advice and are for education purposes only. This book will not automatically get you a million dollars.