The best gains in the stock market are sometimes from the most overlooked stocks. These stocks return amazing returns because their intrinsic valuation does not match the price targets and multiples that analysts are assigning the stocks in question. When price snaps back to intrinsic value like a rubber band, the gains can be significant. My thesis is that Warrior Met Coal (HCC) could be one such overlooked stock play.

Warrior is an almost pure metallurgical coal play which operates mines in Alabama, specifically Brookfield, Alabama. They operate 3 mines: Mine #4, Mine #7 and their upcoming project Blue Creek which has already begun producing coal. In this article, I will go over my thesis, key metrics and share information from the recent earnings presentation.

Industry Dynamics

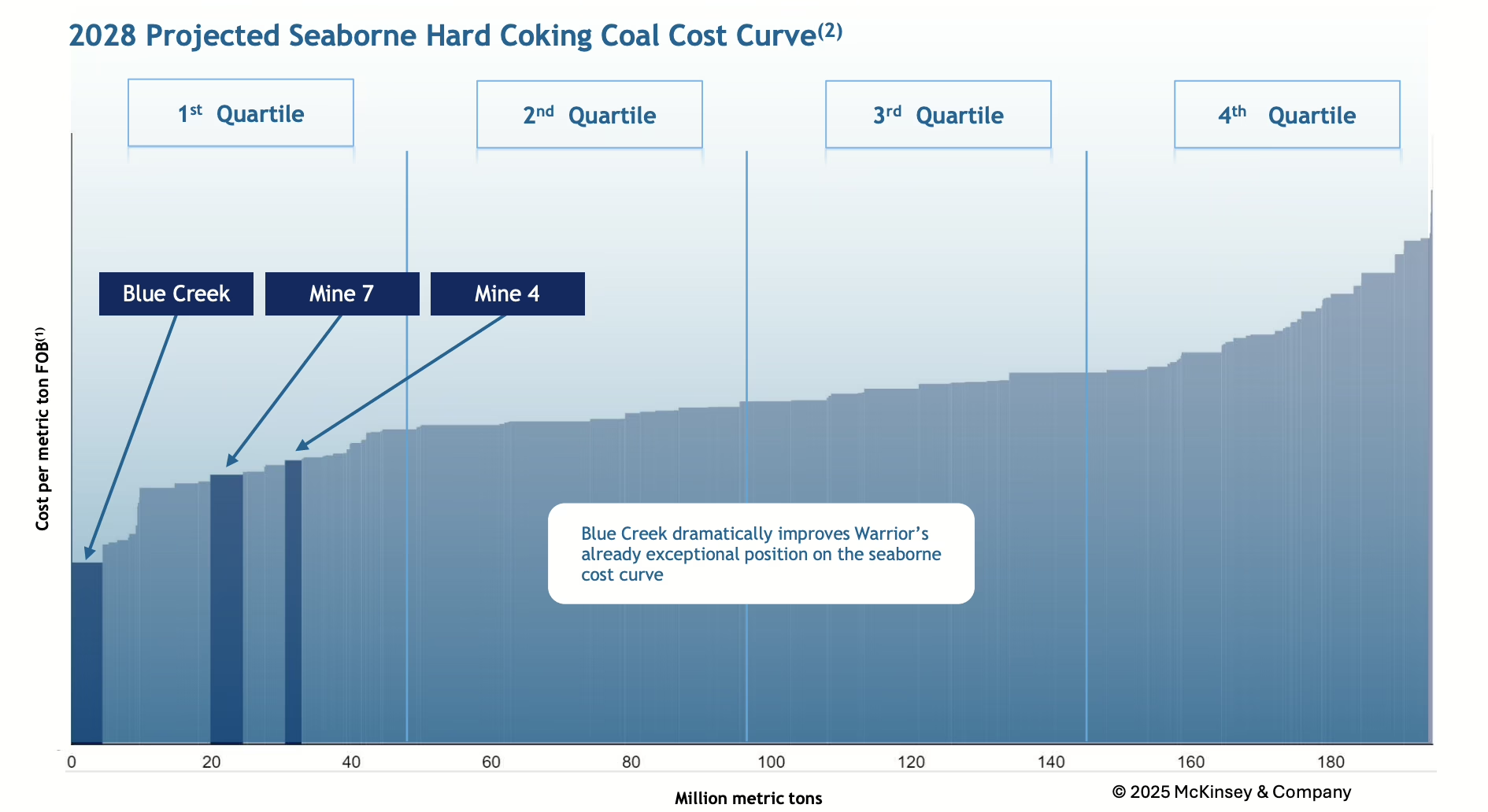

The coal industry has been going through a cyclical bear market due to the low demand from China and other major steel-producing regions of the world. US coal makers realize even less due to shipping costs to ship the coal to the buyers. However, Warrior boasts some of the lowest costs for producing coking coal than other US or global met coal mining operations. Looking at the Blue Creek presentation from February shows that the full production mine #7 and mine #4 already rank in the 1st quartile of seaborne hard coking coal costs.

In addition, Warrior has the ability to get their coking coal to their customers via barge to the Port of Mobile which is a key distinction from other miners in the US. Moreover, these mines are expected to produce coal for 40+ years and Warrior can control how much coal they are willing to put on the market according to the prices of coking coal at any given moment. Thus, if prices are low as they are now, Warrior does not need to push to sell coal to keep their business afloat.

Steel can only really be produced from the blast furnace method using coking coal as the fuel at the current time. Electric arc furnaces are a relatively newer technology used to create steel but they cannot replace the blast furnace method anytime soon, especially in other countries such as India and China. Coking coal prices will rebound as India picks up lowering China demand and this will allow Warrior to boost production to take advantage of the higher coal prices.

China demand seems to be waning at the moment; however Indian demand seems to be increasing. The current state of the coking coal industry is that there is an oversupply on the market which is another factor leading to depressed prices. By all estimates, this oversupply will be absorbed in the coming years and lead to a state of demand over supply again, which will lead to better coking coal prices after the next few years.

Financial Advantages

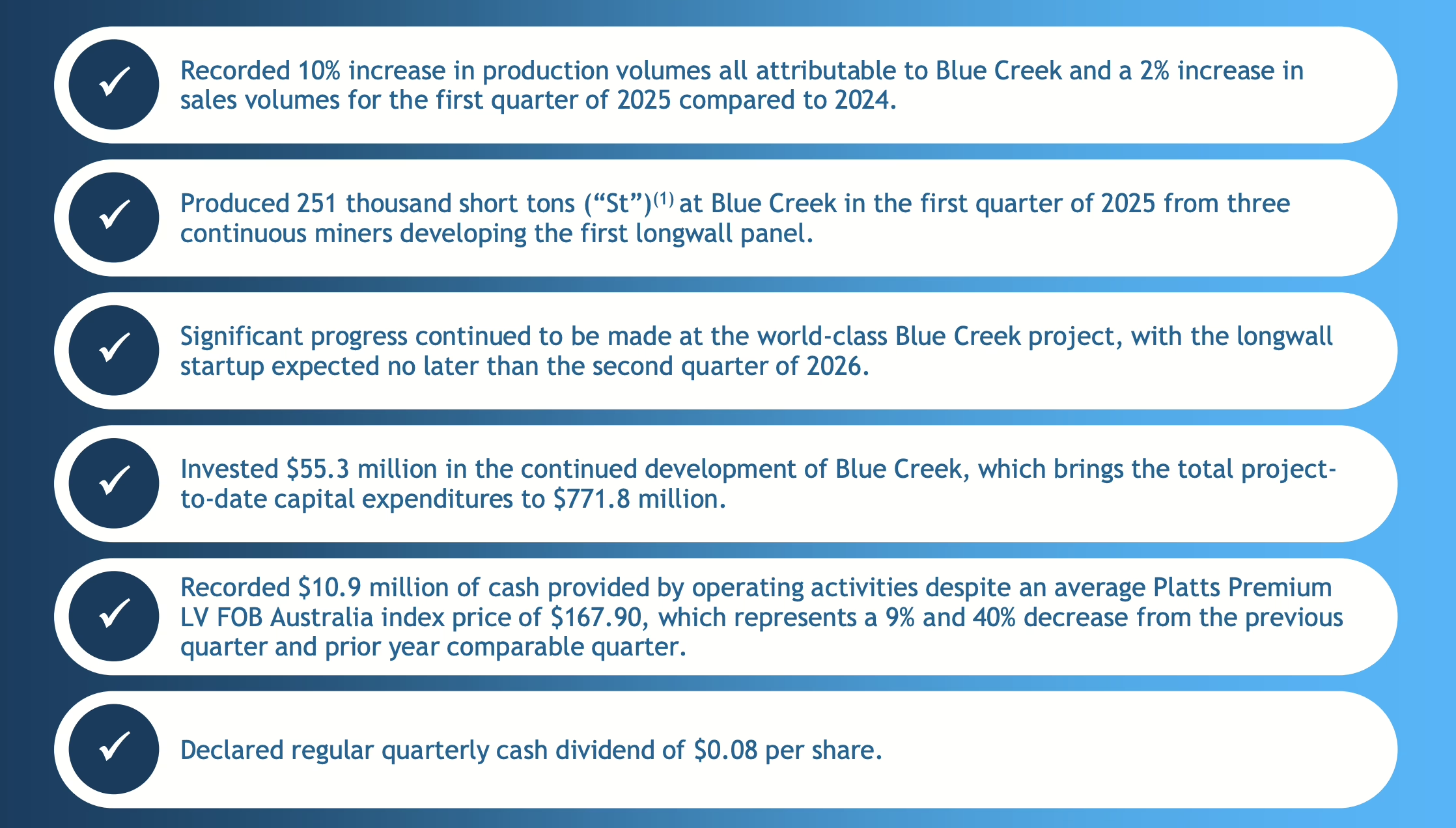

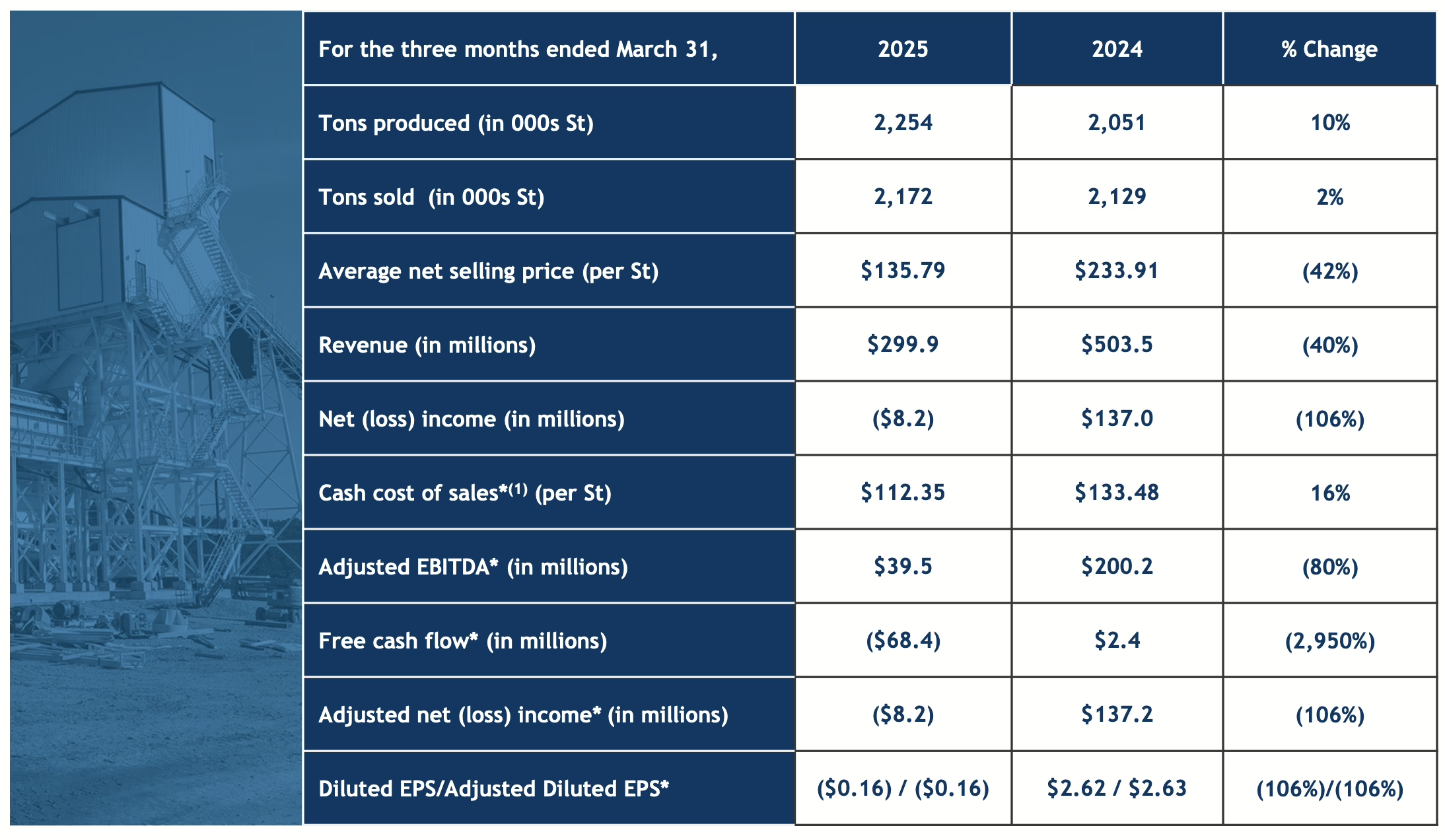

The current state of the industry has placed Warrior in the perfect place to benefit financially if the right conditions are met over the next few years. Let’s look at their most recent financial presentation for 1Q’25 to see highlights from this past quarter.

First you can see that they have ramped up their production on track to hit 13.0-14.0 million short tons a year in 2027 and beyond. This will position them close to Alpha Metallurgical Resources in terms of sheer scale of coal production where, based on data provided in Alpha’s presentation, they are producing somewhere in the range of 16.0-17.0 million short tons a year. Combine that increased production with their low cost to port and mine and that is a winning combination.

They have kept their capital return program with a regular quarterly cash dividend of $0.08 per share, but they have not brought back any buybacks as of yet. This is most likely due to their capex spend on the Blue Creek project where they have spent $772 million to date. An additional $200-$300 million will be needed to complete the project, but the majority of the capex spend has finished. The company is well positioned to pay this remaining $200-$300 million from their free cash reserves so this project seems to be more mature and less risky at this point in time. In addition, they are recording millions from operating activities even with the depressed price of coal, which gives a margin of safety even if the project goes above the highest cost projection.

Looking at year over year progress for key metrics, you can see an increase in production as Blue Creek ramps up and a huge 42% decrease in the average net selling price per short ton. This is the primary reason for the huge decrease in revenues year over year and typical for such a cyclical commodity as coal. With such a decrease, all the other metrics are much lower than this period a year ago. But I would argue that is just the market and those conditions will change in the future.

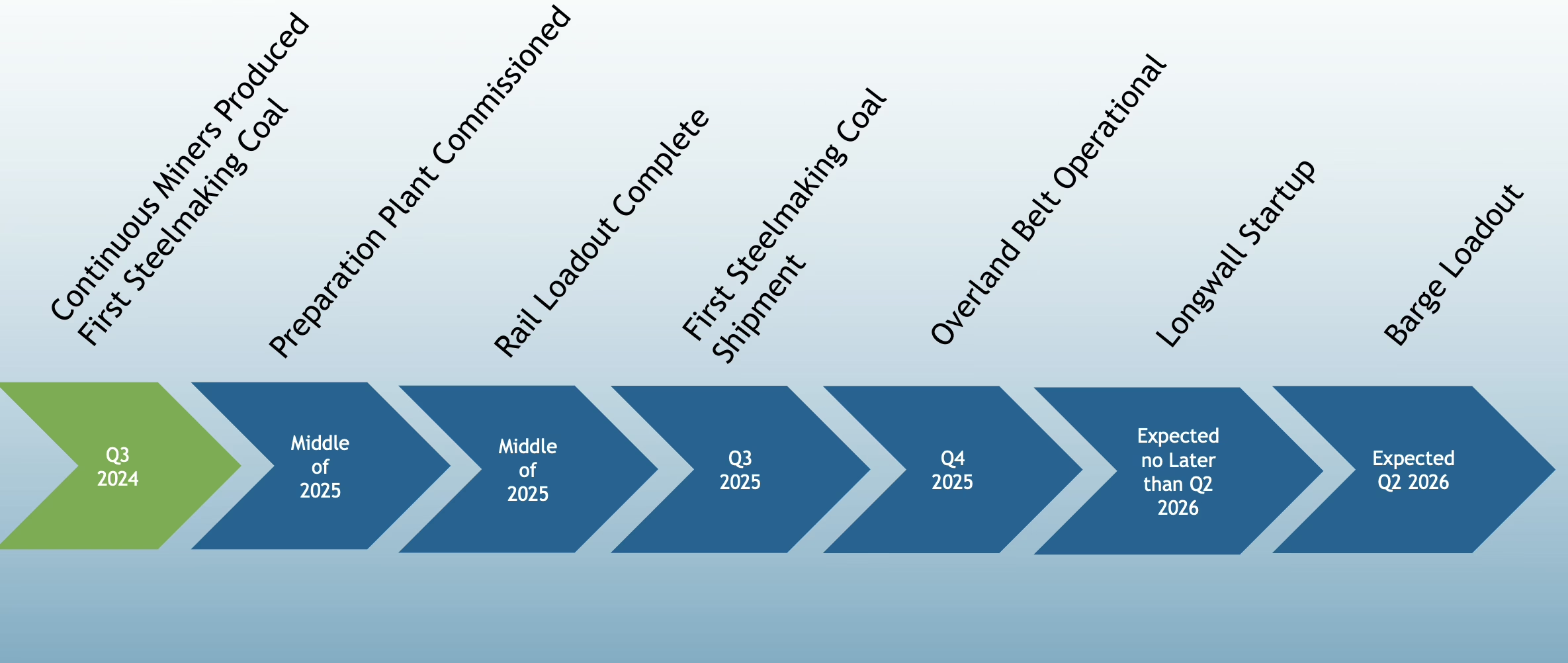

Update on Blue Creek

As mentioned in some points above, the Blue Creek project continues to be on time and on budget with longwall production expected no later than Q2’26 as described in Warrior’s Blue Creek update presentation. A few other things to note are that Warrior expects lower maintenance capex for Blue Creek as it is expected to use more state of the art machinery. With current production in the 4-6 million short ton range, Blue Creek will expand production scale to 13.0-14.0 million short tons leading to windfall in free cash flow if Warrior chooses to put that much coal into supply.

Putting It All Together

So what does all this mean? Well, if Blue Creek finishes on time and on budget, then the capex spend overhead will be finished AND there will be a step increase in the free cash flow from the increased production rate fully realized in 2027 and beyond. But what if that perfect storm hits with increasing India coal demand and supply shocks? We are getting a recipe for a potential multi-bagger at current valuations. Warrior’s marketcap is around $2.5 billion and if the free cash flow is roughly $500 million conservatively with an increase in met coal prices, then we have a stock that has 20% free cash flow to marketcap!

A 20% free cash flow to marketcap ratio is incredibly high. Warrior could start returning this cash to shareholders immediately in the form of stock buybacks and increased dividends. Need an example of what returning cash on this magnitude could look like? Look no further than AMR. AMR bought back 25%-30% of their stock and drove the price approximately 5x higher in conjunction with strong met coal prices between 2023 and 2024. The same could happen to Warrior Met Coal in the future if the perfect storm comes together.

This is probably what super investor Mohnish Pabrai sees in this stock; he increased his holdings of HCC in his Pabrai Investments by a lot. This leads to even greater conviction about the stock being potentially undervalued and overlooked, but as always do your own due diligence in coming to investment decisions.

Disclosure – I own shares of HCC in my public portfolio and will be adding more to my positions in the near future.