PayPal just reported earnings for 1Q’25. PayPal is a multi-faceted business so let’s try to understand PayPal’s business and get further insight into the metrics that are relevant. To get the clearest picture of their business operations let’s look at their 10K. According to their latest 10K filed with the SEC:

Business model & segments

Key metrics to understand

Total payment volume

Total Payment Volume (TPV) is the total monetary value of all transactions processed through their platform over a specific timeframe. This is a key performance indicator of PayPal’s overall performance as how much volume is passing through PayPal’s processing. This TPV value does not include payment transaction reversals, so it is recording successful transactions only.

Transaction margin dollars

Another key metric is transaction margin dollars (TM$). This metric is a measure of how much profit PayPal keeps for each transaction like a transaction margin percentage. This usually is broken out as total transaction margin dollars and transaction margin dollars excluding customer balances.

Active accounts & monthly active accounts

Other improvements

Any key metric improvements in PayPal and Venmo will be seen as positive for the company.

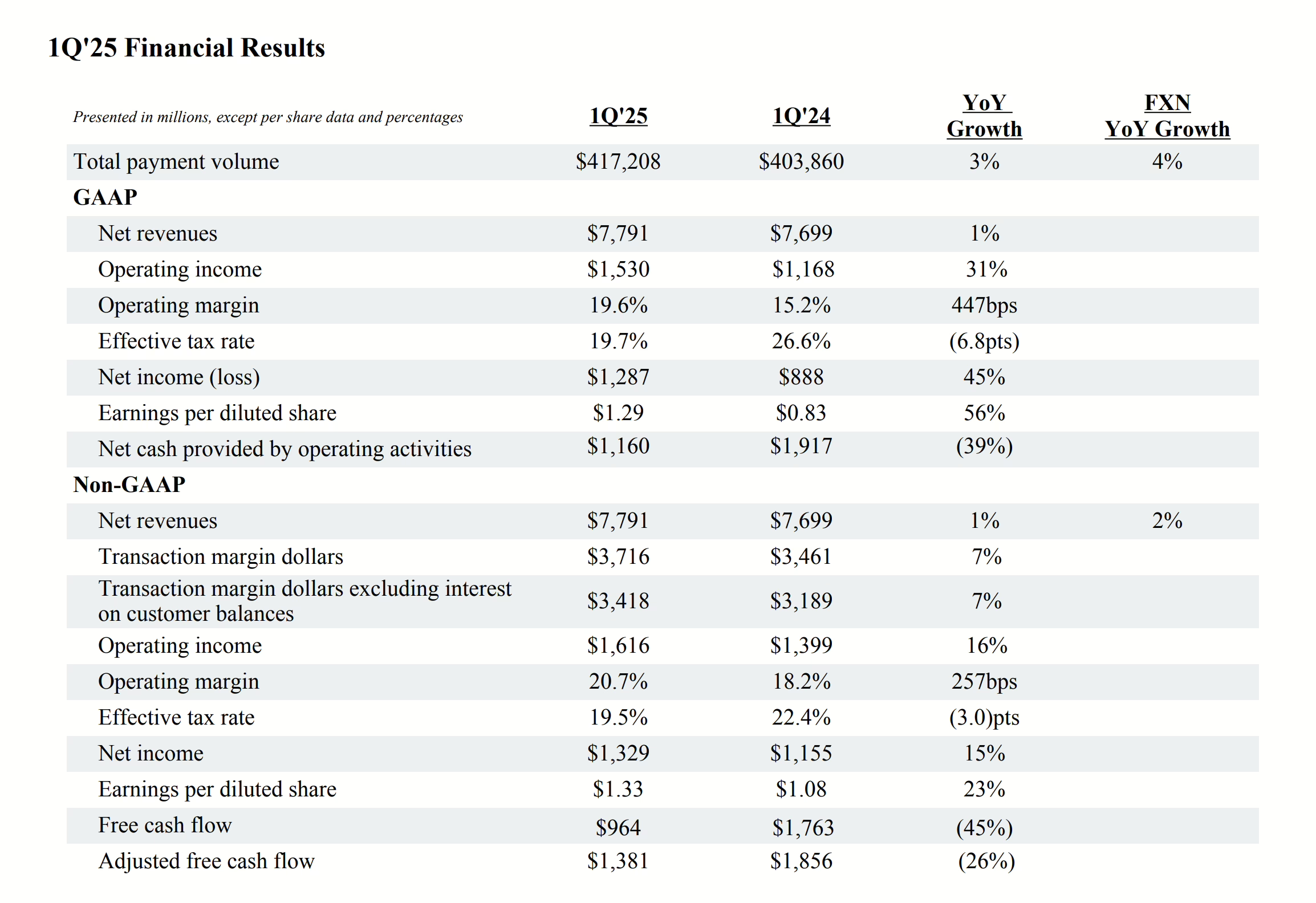

Financial results

Based on the results provided during the earnings release, I see several improvements in the key metrics. TPV increased 3% YoY and TM$ increased 7% YoY. Both GAAP and non-GAAP reported net revenues increased 1% and operating margin increased as well. There was a notable drop in free cash flow seemingly from the drop in net cash year over year. Net revenues were up only 1% YoY; however, Alex Chriss has placed an emphasis on higher quality clients and trimming those are unprofitable. Even with that reduction, they were able to post positive net revenue which bodes well once they have finished making their client base higher quality.

Guidance

PayPal continued guidance citing uncertainty around the macroeconomic picture of the world at the current moment. They are projecting a free cash flow of $6-$7 billion for fiscal year 2025 with ~$6 billion in stock repurchases going forward. Transaction margin dollars are guiding toward a 4-5% growth and EPS growth around 6-10% range. Overall the guide remains steady and keeps PayPal stock in the firm value proposition category, while growth remains steady but muted.

Conclusion

PayPal is an attractive value proposition for long-term holders. With their $6-$7 billion free cash flow generation, large stock repurchases and fairly steady but low growth, they are handing cash back to investors who are playing the long game.

I do not own shares of PYPL, but I may buy shares soon in the public portfolio.