The Honest Company (NASDAQ: HNST), co-founded by actress Jessica Alba, emerged onto the scene in 2012 with a compelling mission: to create safe, effective, and beautifully designed products for babies and the home, all while adhering to principles of transparency and sustainability. This ethos quickly resonated with a growing consumer base seeking alternatives to conventional products often laden with harsh chemicals and questionable ingredients. The company’s initial focus on diapers and wipes expanded to encompass a wide range of personal care, beauty, and household cleaning products, all marketed with a commitment to clean formulations and environmental consciousness.

After a period of rapid growth and a successful initial public offering (IPO) in May 2021, HNST now navigates the complexities of the public market while striving to maintain its core values and achieve sustainable profitability. In this article, I will dissect the company’s business model, analyze its financial performance, evaluate its competitive landscape, perform a DCF model given some conservative assumptions, and ultimately assess whether it presents a compelling investment opportunity in the current market environment.

Understanding Their Business Model

HNST operates with a multi-channel distribution strategy, encompassing both direct-to-consumer (DTC) sales through its e-commerce platform and partnerships with major retailers such as Target, Walmart, and Whole Foods. You may have seen their products on shelves at many of these stores and more. Recently I saw several HNST products in the baby aisle of my local HEB store in Houston. This multi-faceted approach allows the company to reach a broad audience, leveraging the convenience of online shopping while also capitalizing on the foot traffic and brand visibility offered by brick-and-mortar stores.

A significant aspect of the company’s early success was its subscription model, offering customers recurring deliveries of bundled products at a discounted rate. This enabled them to foster customer loyalty and obtain a predictable revenue stream. While the subscription model remains a part of its strategy, HNST has also focused on expanding its single-item sales both online and in retail locations to cater to a wider range of consumer preferences.

The core tenets of the HNST business model can be summarized as follows:

- Clean and Sustainable Products: The central pillar is the commitment to formulating products without harmful chemicals, utilizing plant-based ingredients where possible, and prioritizing sustainable sourcing and packaging. This resonates with environmentally and health-conscious consumers, a growing segment of the market.

- Transparency: The company emphasizes transparency in its ingredient lists and manufacturing processes, building trust with consumers who are increasingly scrutinizing the contents of the products they purchase.

- Brand and Design: HNST invests in attractive and functional packaging, aiming to create a premium feel that justifies its price point compared to some conventional alternatives. The association with co-founder Jessica Alba also provides significant brand recognition and appeal.

- Multi-Channel Distribution: The combination of DTC and retail partnerships provides both convenience for consumers and broad market access for the company.

- Customer Engagement: HNST actively engages with its customer base through social media, email marketing, and community initiatives, fostering a sense of loyalty and gathering valuable feedback.

Analyzing Their Financial Performance

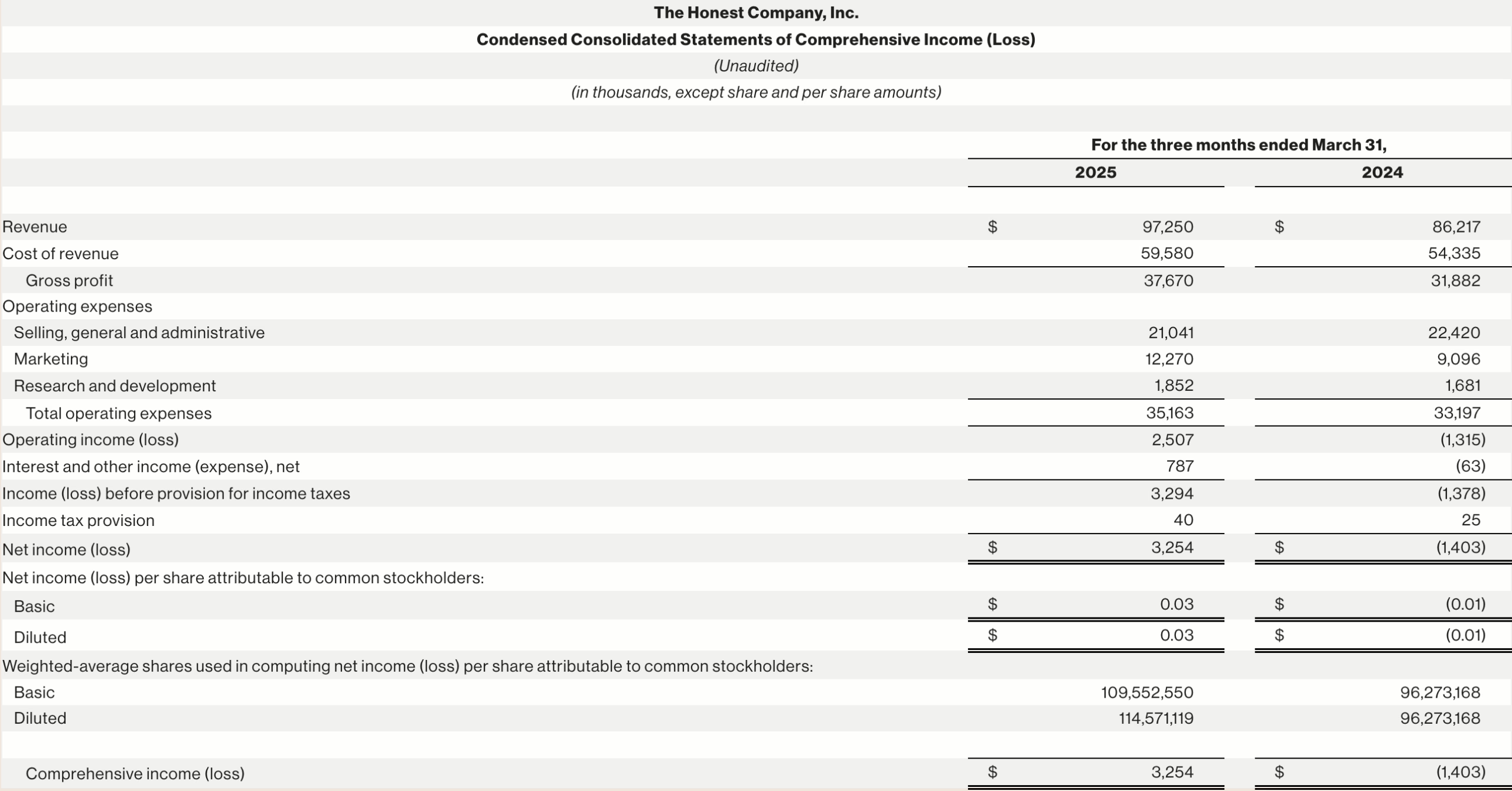

A thorough evaluation of company’s investment potential requires a close examination of its financial health and performance trends. Recent financial reports offer insights into the company’s progress and challenges. Let’s look at the consolidated report from the most recent quarter:

Revenue Growth: HNST has demonstrated consistent revenue growth. In the first quarter of 2025, the company reported a 13% increase in revenue compared to the same time-frame in the prior year, reaching $97.25 million. This growth was attributed to strong performance in its wipes and baby personal care product portfolios. For the full year 2024, revenue increased by 10% to $378 million over the prior year. This indicates a positive trajectory in terms of sales expansion; if revenue stays the same or increase for the remaining quarters of 2025 then the company is on track to post an increase year over year again.

Gross Margin: Gross margin, which represents the percentage of revenue remaining after deducting the cost of goods sold, is a crucial indicator of profitability. The company has shown significant improvement in this area. In the first quarter of 2025, the gross margin expanded to 39%, a 170 basis point increase year-over-year. The full year 2024 saw an even more substantial expansion of 900 basis points to 38.2%. This improvement is attributed to product cost savings, supply chain efficiencies, and favorable product mix.

Profitability: Achieving consistent profitability has been a challenge for HNST since its inception. However, the company reported net income of $3.2 million in the first quarter of 2025, a significant improvement compared to a net loss of $1.4 million in the same period the previous year. While the full year 2024 still resulted in a net loss of $6 million, this was a substantial improvement compared to the $39 million net loss in 2023. The company also reported positive adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of $26 million for 2024 and $7 million for the first quarter of 2025, demonstrating progress towards sustainable profitability.

Operating Expenses: Operating expenses, including selling, general, and administrative costs, as well as marketing expenses, remain a significant portion of the company’s revenue. In the fourth quarter of 2024, operating expenses increased as a percentage of revenue, driven by higher selling, general, and administrative expenses, including legal costs, and increased retail marketing expenses. Efficiently managing these expenses will be crucial for sustained profitability. They were able to bring down selling, general, and administrative costs in Q1’25 versus Q1’24, but this was offset by the increase in the marketing expenses.

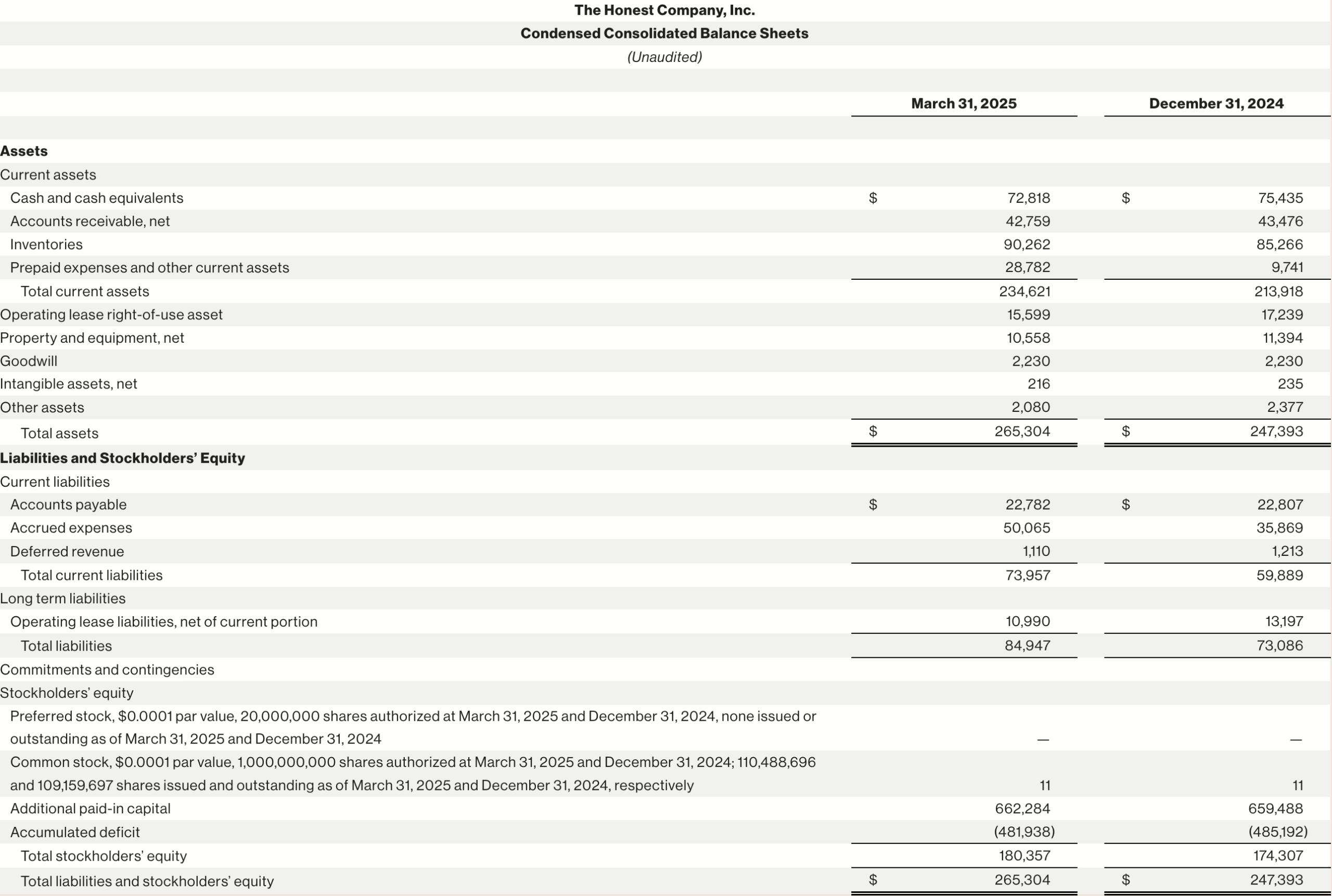

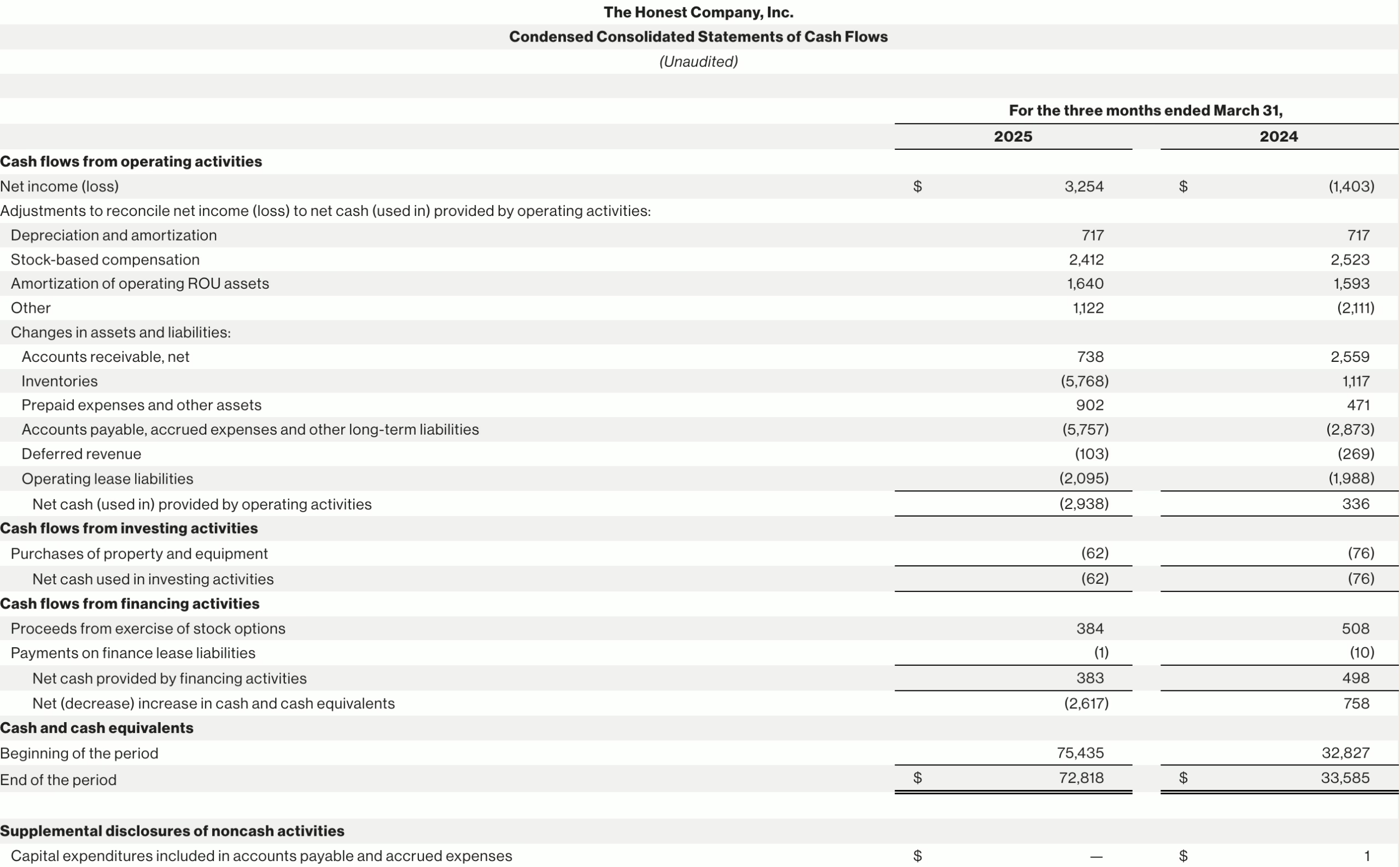

Cash Flow and Balance Sheet: The company maintains a healthy balance sheet with a strong cash position and no debt. As of the end of the first quarter of 2025, the company had $72.8 million in cash and cash equivalents, a more than 100% increase compared to the previous year, primarily due to the exercise of stock options. This strong financial position provides flexibility for future growth initiatives and navigating potential economic headwinds.

Future Outlook: HNST has reaffirmed its financial outlook for the full year 2025, expecting revenue growth of 4% to 6% and positive adjusted EBITDA in the range of $27 million to $30 million. This guidance suggests continued confidence in its strategic direction and execution.

Evaluating the Competitive Landscape

The company operates in a competitive landscape within the consumer goods industry, facing competition from established multinational corporations, private-label brands, and other emerging natural and organic product companies.

Major Competitors: Large players like Procter & Gamble, Unilever, and Johnson & Johnson have significant market share and extensive distribution networks. While they may offer some natural or eco-friendly product lines, their core focus often lies in conventional products.

Private Label Brands: Retailers like Target (with its Everspring and Cloud Island brands) and Walmart offer their own private-label alternatives that often compete on price. These brands can leverage the retailers’ strong distribution and brand recognition.

Natural and Organic Brands: Numerous smaller companies focus specifically on natural, organic, and sustainable products, creating a fragmented but competitive market. Brands like Seventh Generation, Babyganics, and various direct-to-consumer clean beauty brands operate in similar spaces. The natural, organic, and sustainable product space seems to be getting more saturated as consumers start to look for these health-conscious brands.

Competitive Advantages: Despite the competition, HNST possesses certain competitive advantages:

- Strong Brand Identity: The company has cultivated a strong brand image associated with safety, transparency, and sustainability, which resonates with a specific consumer segment. The involvement of Jessica Alba adds a unique element of celebrity endorsement and brand recognition.

- Focus on Clean Formulations: The unwavering commitment to clean ingredients differentiates HNST from many conventional brands and some private-label offerings.

- Multi-Channel Presence: The ability to reach consumers through both online and physical retail channels provides a broader market reach than some smaller, purely DTC brands.

- Subscription Model (though evolving): While no longer the sole focus, the subscription option still provides a base of recurring revenue and fosters customer loyalty.

- Innovation and Product Expansion: The company continues to expand its product lines, entering new categories within personal care, beauty, and household, providing opportunities for growth.

Competitive Challenges:

- Price Point: Honest Company products often carry a premium price compared to conventional and some private-label alternatives, which can be a barrier for price-sensitive consumers.

- Maintaining Differentiation: As more companies enter the natural and sustainable space, HNST needs to continuously innovate and reinforce its unique value proposition.

- Achieving Scale and Profitability: While progress has been made, achieving consistent and significant profitability in a competitive market requires efficient operations and cost management.

- Consumer Perception: The company has faced some past scrutiny regarding the “honesty” of certain ingredients, which has the potential to impact consumer trust. Maintaining transparency and product integrity is crucial.

Assessing the Investment Opportunity

Based on the analysis of the company’s business model, financial performance, and competitive landscape, several factors need to be considered when evaluating its investment potential.

Positive Factors

- Strong Revenue Growth: The company has demonstrated consistent top-line growth, indicating increasing consumer demand for its products.

- Improving Gross Margins: Significant expansion in gross margins suggests better cost management and pricing power.

- Path to Profitability: Recent financial results show a clear trend towards profitability, with positive net income in the latest quarter and positive adjusted EBITDA.

- Healthy Balance Sheet: A strong cash position and no debt provide financial stability and flexibility for future investments.

- Growing Market for Natural and Sustainable Products: The increasing consumer awareness of health and environmental issues creates a favorable market for the company’s offerings.

- Established Brand and Multi-Channel Distribution: The company has built a recognizable brand and a robust distribution network.

Negative Factors

- Competitive Landscape: The consumer goods industry is highly competitive, with established players and emerging brands vying for market share.

- Premium Pricing: The higher price point of Honest Company products may limit its appeal to certain consumer segments, especially during economic downturns.

- Past Scrutiny: Previous controversies regarding product ingredients could potentially impact consumer trust and brand reputation.

- Need for Continued Innovation: To maintain its competitive edge, the company must continuously innovate and adapt to evolving consumer preferences and market trends.

- Operating Expense Management: Effectively managing operating expenses will be crucial for translating revenue growth into sustained profitability.

Long-Term Potential

- Sustain revenue growth by expanding its product lines, entering new markets, and effectively competing in its existing categories.

- Maintain and further improve its gross margins through efficient supply chain management and strategic pricing.

- Achieve and sustain profitability by effectively managing operating expenses and leveraging its scale.

- Continuously innovate and adapt to evolving consumer preferences and maintain its brand differentiation in the face of increasing competition.

- Maintain consumer trust and brand loyalty by upholding its commitment to transparency and product quality.

Analyst Sentiment and Stock Performance: As of May 16, 2025, analyst ratings for HNST are mixed but generally leaning positive. The consensus rating is a “buy,” based on a number of “buy” and “hold” recommendations. The median price target among analysts suggests a significant upside potential from the current trading price. The stock has shown considerable volatility since its IPO but has experienced positive momentum in recent periods. Institutional ownership in the company is significant, indicating some confidence from professional investors.

Discounted Cash Flow Modeling

Using my discounted cash flow calculator, we can model potential scenarios for the price of HNST in any given timeframe based on potential future cash flows. It is difficult to do a DCF model on a company like HNST as their free cash flow for Q1’25 was approximately -$3m. We will need more data from a few quarters where HNST is posting positive free cash flow to get a more accurate look fro a discounted cash flow basis.

Conclusion

Investing in HNST presents a nuanced opportunity. The company has made significant strides in recent periods, demonstrating strong revenue growth, improving gross margins, and a clear path towards profitability. Its commitment to clean and sustainable products aligns with a growing consumer demand, and its established brand and multi-channel distribution provide a solid foundation for future growth.

However, investors must also acknowledge the risks associated with a competitive market, the premium pricing of its products, and the need for continuous innovation and efficient operations. While analyst sentiment appears cautiously optimistic, the company’s past volatility underscores the importance of a long-term perspective and careful consideration of its ability to execute its strategic plans.

Ultimately, whether HNST is a “good” investment depends on an individual investor’s risk tolerance, investment horizon, and belief in the company’s ability to capitalize on the growing market for natural and sustainable consumer goods while effectively navigating the competitive landscape and achieving sustained profitability. Continued monitoring of the company’s financial performance, competitive positioning, and management execution will be crucial for making informed investment decisions.

The recent positive financial trends and reaffirmed outlook for 2025 suggest that HNST is making progress, but its long-term success will depend on its ability to maintain this momentum and consistently deliver value to its customers and shareholders. I will be looking for more financial data in the upcoming quarters before deciding to invest into HNST.

Disclosure: I do not own HNST and am considering it’s potential in my public portfolio. This is not financial advice, do your own due diligence