Every quarter, institutional investment managers with over $100 million in assets under management are required to file a Form 13F with the U.S. Securities and Exchange Commission (SEC). These filings disclose their equity holdings as of the end of that quarter. While 13F filings provide a glimpse into the investment strategies of prominent investors—often referred to as “super investors”—it’s crucial to remember that they have limitations.

The data is backward-looking, doesn’t include short positions, and may not reflect the investor’s complete portfolio (e.g., it excludes fixed income and private investments). In addition, these investors are required to disclose their holdings within 45 days of the end of the calendar quarter. Therefore, it’s possible that the holdings could look entirely different than what is shown on the 13F.

In this article I will dive into specific 13F filings for the first quarter of 2025, focusing on the portfolio adjustments made by several well-known super investors: Warren Buffett, Bill Ackman, Michael Burry, Terry Smith, Mohnish Pabrai, and Chris Hohn. These investors manage billions of dollars worth of investments and changes in these holdings could tell us something about the nature of those investments. I’ll analyze their key holdings, changes in positions, and potential insights into their investment philosophies and market outlook.

Warren Buffett – Berkshire Hathaway

Warren Buffett, the “Oracle of Omaha,” is renowned for his long-term value investing approach. Watching Berkshire Hathaway’s 13F filings is useful because of this long-term outlook as the 13F is backward-looking as mentioned earlier. Which means that we can have more certainty in that Berkshire holdings being similar to when the holdings were disclosed in the first place. When I look at Berkshire Hathaway’s 13F, I personally do not see major changes. Warren Buffett is still holding a tremendous amount of cash and is possibly waiting on a better entry point for the market.

- Key Holdings: In Q1 2025, Berkshire Hathaway’s portfolio stayed concentrated in a few core holdings. Apple (AAPL) continues to be the largest position at around 25.76% of the portfolio, reflecting Buffett’s confidence in the tech giant’s brand strength and ecosystem. Other significant holdings include Bank of America (BAC), American Express (AXP), and Coca-Cola (KO).

- Notable Changes: One of the most intriguing aspects of Berkshire’s Q1 2025 filing is the continued buildup of cash reserves. This trend, which has been ongoing for several quarters, suggests that Warren Buffett is still taking a cautious stance on the overall market. In addition, there were large percent increases in POOL and STZ, although these are minuscule pieces of the total portfolio.

- Confidential Holdings: Berkshire’s 13F filing also indicates the use of confidential treatment for a new stock purchase. This allows Berkshire to accumulate a significant position without disclosing it to the market, potentially securing a better entry price. There is speculation about the identity of this “secret” stock, and some analysts are suggesting it may be in the financial sector.

- Overall Strategy: Buffett’s strategy appears to be one of patience and selectivity. While maintaining core holdings in companies with strong competitive advantages, he is also prioritizing building a war chest of cash. This approach aligns with his value investing principles and his focus on long-term capital preservation.

Bill Ackman – Pershing Square Capital Management

Bill Ackman is known for his concentrated, activist investing style. Pershing Square Capital Management’s 13F filings reveal his high-conviction bets on a select group of companies. I definitely like his concentrated stock approach and want to analyze some of the stocks in his holdings.

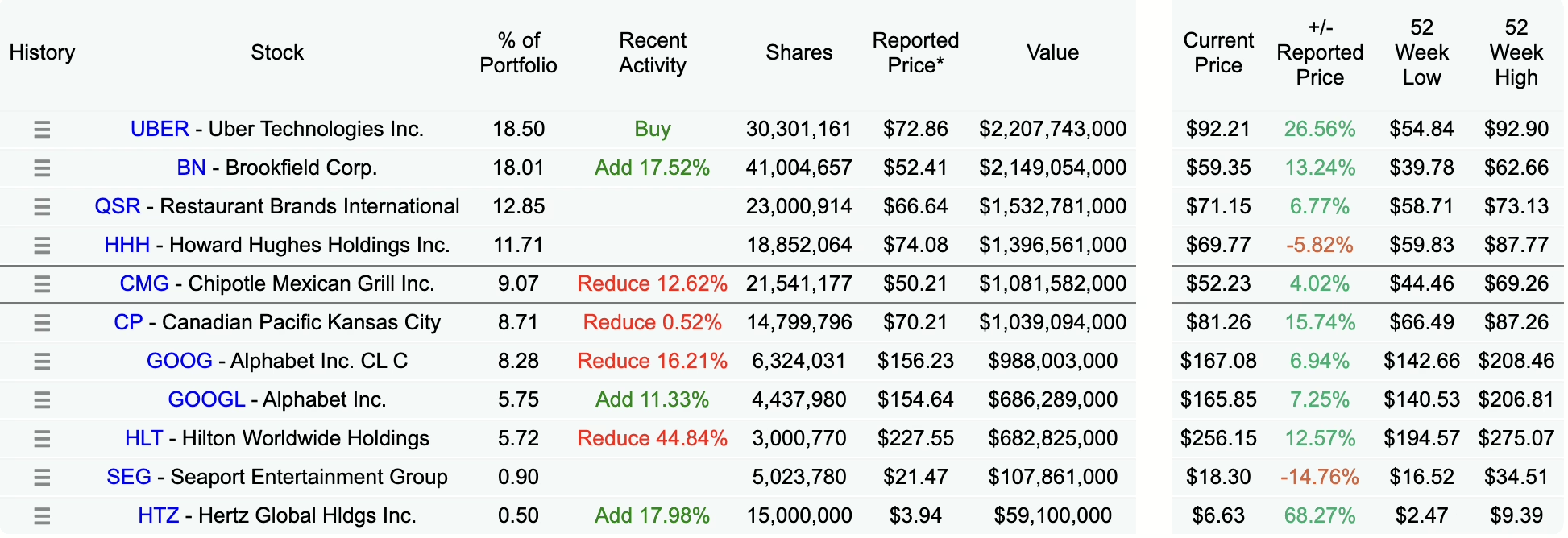

- Key Holdings: Ackman’s portfolio remains highly concentrated, with a few key holdings dominating. Uber Technologies Inc. (UBER) emerges as the largest position, probably signaling Ackman’s belief in the company’s long-term growth potential in the mobility and delivery sectors. Brookfield Corp. (BN) also remains a core holding, reflecting Ackman’s focus on high-quality businesses with strong management.

- Notable Changes: The most significant change in Pershing Square’s Q1 2025 portfolio is the substantial position in Uber. This new investment indicates a shift in Ackman’s focus and a belief that Uber is undervalued (I will need to do a deep-dive into Uber to understand whether it is intrinsically undervalued). Ackman also made adjustments to his Alphabet (GOOGL/GOOG) holdings, increasing Class A shares while reducing Class C shares. He could have done this to increase the his control of voting shares or just to consolidate into the Class A shares. The SEC treats GOOGL and GOOG as the same company so wash sale rules still apply. In addition, he had a significant reduction in Chipotle maybe underscoring his perceived impact of the CEO leaving for Starbucks a few months ago.

- Other holdings: Ackman’s portfolio also includes Restaurant Brands International (QSR), Howard Hughes Holdings Inc. (HHH), and Chipotle Mexican Grill Inc. (CMG).

- Overall Strategy: Ackman’s moves suggest a focus on concentrated, long-term investments in businesses that he believes have significant upside potential. His new position in Uber reflects a willingness to make bold bets on companies he views as disruptors with strong competitive advantages.

Michael Burry – Scion Asset Management

Michael Burry is notorious for predicting the 2008 financial crisis. His Scion Asset Management’s 13F filings are usually combed through for insights into his contrarian and often bearish views. I don’t usually look at Scion Asset Management for signs, but sometimes it’s good to look at just to see if there is a glaring change. His style of rapid adjustments and lack of a long-term value style are counter to my own strategies and investments.

As he liquidated his portfolio and bought only Estée Lauder (EL), I won’t include the data of the 13F from DataRoma

- Key Holdings: Burry’s Q1 2025 portfolio shows a dramatic shift to a highly bearish stance. He allocated a significant portion of his portfolio to put options basically betting against the market. Most notably, he has a massive short position against NVIDIA (NVDA) via put options. I’m not sure why he has taken such a stance but maybe he sees AI or semiconductor chips phasing out somehow.

- Notable Changes: By reducing his portfolio the number of holdings, he is concentrating his bets in a few key positions. He also moved from long positions to put options in several Chinese tech companies, including Alibaba (BABA), PDD Holdings (PDD), and JD.com (JD).

- Bearish Stance: Burry’s Q1 2025 activity is suggesting a strong conviction that the market is overvalued and due for a correction. His large short position in NVIDIA, a leader in the AI sector, is a particularly bold bet against the prevailing market narrative.

- Overall Strategy: Burry’s strategy in Q1 2025 is highly contrarian and risk-averse. He appears to be positioning his portfolio for a potential market downturn, focusing on shorting companies he believes are overvalued.

Terry Smith – Fundsmith LLP

Terry Smith is a UK-based fund manager known for his “quality growth” investing style. Fundsmith LLP’s 13F filings (while Fundsmith is a UK firm, they hold US-listed securities) reveal a focus on high-quality companies with durable competitive advantages.

- Key Holdings: Fundsmith’s portfolio is concentrated in a selection of large-cap, multinational companies with strong brands and consistent growth. Top holdings include Meta Platforms (META), Microsoft (MSFT), and Stryker Corporation (SYK).

- Consistent Approach: Terry Smith is known for his low-turnover approach, and the Q1 2025 filings reflect this. The portfolio remains relatively stable, with minimal changes in core holdings. This consistency underscores Smith’s focus on long-term investing in companies with enduring business models. This model reflects mine own quite a lot, basically “buy right and hold on”.

- Quality Focus: Fundsmith’s holdings exemplify its focus on “quality” companies. These are businesses with high returns on capital, strong free cash flow, and the ability to grow earnings consistently over time.

- Overall Strategy: Smith’s strategy in Q1 2025 remains consistent with his long-term approach: identify and hold high-quality businesses. This approach emphasizes fundamental analysis, patience, and a focus on intrinsic value.

Mohnish Pabrai – Pabrai Investment Funds

Mohnish Pabrai is a value investor who closely follows the principles of Warren Buffett and Charlie Munger. Pabrai Investment Funds’ 13F filings reveal a concentrated portfolio of undervalued businesses. It is important to note that most of Mohnish’s investments are overseas in other countries.

- Key Holdings: Pabrai’s portfolio is highly concentrated in a small number of holdings. His top holdings included Alpha Metallurgical Resources Inc. (AMR), Consol Energy Inc. (CEIX), and Warrior Met Coal Inc. (HCC).

- Notable Changes: One of the most interesting things from the 13F filing is that Mohnish sold AMR and increased HCC. As I have it in the public portfolio, this gives me another layer of conviction in my choice in Warrior Met Coal as a multi-bagger for the next few years

- Concentrated Bets: Pabrai’s strategy involves making concentrated bets on companies he believes are significantly undervalued. His holdings in the latest 13F reflects this approach, with a large portion of the portfolio being allocated to a few specific sectors.

- Value Focus: Pabrai’s investments appear to be focused on cyclical commodity industries. This suggests he sees significant value in these companies due to long-term supply/demand dynamics or undervaluation relative to their intrinsic worth. This makes sense with a long-term valuation stock analysis approach to investing.

- Overall Strategy: Pabrai’s Q1 2025 activity reflects his value investing philosophy, characterized by concentrated bets on undervalued businesses. His focus on cyclical sectors suggests a belief in their long-term recovery and growth potential.

Chris Hohn – TCI Fund Management

Chris Hohn is the founder of The Children’s Investment Fund Management (TCI), a hedge fund known for its long-term, concentrated investments and activist approach. His fund manages well over $40 billion dollars and it is important to see what changes he made to this fund.

- Key Holdings: TCI’s portfolio is concentrated in a selection of large-cap companies across various sectors. His major holdings include General Electric Co. (GE), Microsoft (MSFT), Moody’s Corp. (MCO), and Visa Inc. (V).

- Long-Term Approach: TCI is known for its long-term investment horizon, and the 13F filings reflects this. The fund tends to hold its positions for extended periods, allowing its investment thesis to play out.

- Activist Stance: TCI is also known for its activist approach, engaging with company management to drive shareholder value. While 13F filings don’t directly reveal activism, Hohn’s concentrated positions often give him significant influence over the companies he invests in.

- Overall Strategy: Hohn’s strategy focuses on identifying and holding high-quality companies with strong competitive positions and long-term growth potential. His concentrated portfolio and activist tendencies reflect a desire to maximize shareholder value.

Conclusion

The 13F filings for Q1 2025 provide a glimpse into the diverse strategies of these super investors. While Warren Buffett remains patient and focused on long-term value, Bill Ackman made a significant new bet on Uber. Michael Burry has adopted a highly bearish stance, concentrating his portfolio in put options. Terry Smith continues to emphasize high-quality growth companies, and Mohnish Pabrai is focusing on undervalued cyclical businesses. Chris Hohn continues to maintain a concentrated portfolio of large-cap companies.

We can infer from these 13F filings that these super investors are some things we can emulate. For example, the majority of them concentrate their bets which is one of the tenets I talk about in my finding a 100-baggers article and video. Also, finding undervalued stocks to their intrinsic value is key in finding stocks that will actually give you a good return. It’s important to remember that 13F filings are just one piece of the puzzle as they are backward-looking. By analyzing the moves of these super investors, we can gain valuable insights into different investment philosophies and potential market trends.

Disclosure: None of the stocks mentioned are for financial advice. Investors should conduct their own thorough research and consider their own investment goals and risk tolerance before making any investment decisions.