Options are a powerful tool that you can use with strategic flexibility in the markets. While they may seem complex at first glance, a clear understanding of them will open the door to you using advanced investing strategies, risk management, and speculative opportunities to your advantage.

In this guide, I will be creating a comprehensive and detailed guide to understanding, using, and ultimately making money from options.

What Are Options?

An option is essentially a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset (which for the purposes of this article will always be a stock) at a set price (called the strike price) within a specified time frame (called the expiration date).

There are two fundamental types of options:

-

Calls (Long): Gives the holder the right to buy the stock at the strike price.

-

Puts (Long): Gives the holder the right to sell the stock at the strike price.

Each standard options contract typically represents 100 shares of the underlying stock, although there are mini options usually on indices due to the high price of the underlying. These mini option contracts usually represent 10 shares of the underlying index.

To make the fundamental options slightly more complicated, I should note that you can also sell or go short calls and puts. This would look like this:

-

Calls (Short): The shorter or seller has the obligation to handover 100 shares to the buyer at the strike price at which they sold the call.

-

Puts (Short): The shorter or seller has the obligation to buy 100 shares from the buyer at the strike price at which they sold the put.

As you can see, selling options is more risky than buying options. The risk taken for making income from selling options is the inherent lack of control of the outcome in the underlying plus the actions of the buyer. With American-style options (which are all the options on the US markets basically), options can be exercised at anytime up to the expiration date.

Exercising an option simply means that the buyer of the option can buy or sell the underlying shares from the seller of the option. European-style options can only be exercised at the time of expiration.

Key Terminology to Know

That was a lot of information with a lot of terminology, so let’s summarize some terms first:

-

Strike Price: The price at which the underlying stock can be bought or sold.

-

Premium: The cost of the option if you are a buyer and the profit from an option if you are a seller .

-

Expiration Date: The last date the option can be exercised.

-

In the Money (ITM): When exercising the option would be profitable.

-

Out of the Money (OTM): When exercising the option would not be profitable.

-

At the Money (ATM): When the stock price and strike price are the same or very close.

Why Options?

I described some of the terminology and basic concepts of options, but the more important question is why do we need options? Well, options are very useful tools for a few reasons. The first reason is leverage; since options represent 100 shares of the underlying stock, you are getting able to leverage your money much more with options rather than buying the stock shares outright.

For example, if you wanted to buy 100 shares of AAPL for $200, you would need $20,000 to complete that trade. However, you can buy a call option that represents that 100 shares of AAPL for a few hundred dollars depending on expiration date and strike price. The sheer number of options, no pun intended, with options is immeasurable. It is this flexibility that makes options so powerful.

Simple Strategies

The simplest strategies are often the most effective not only in repeatability but also in risk management which is a huge part of options strategizing. Strategies such as a protective put or a covered call are most basic and offer great flexibility.

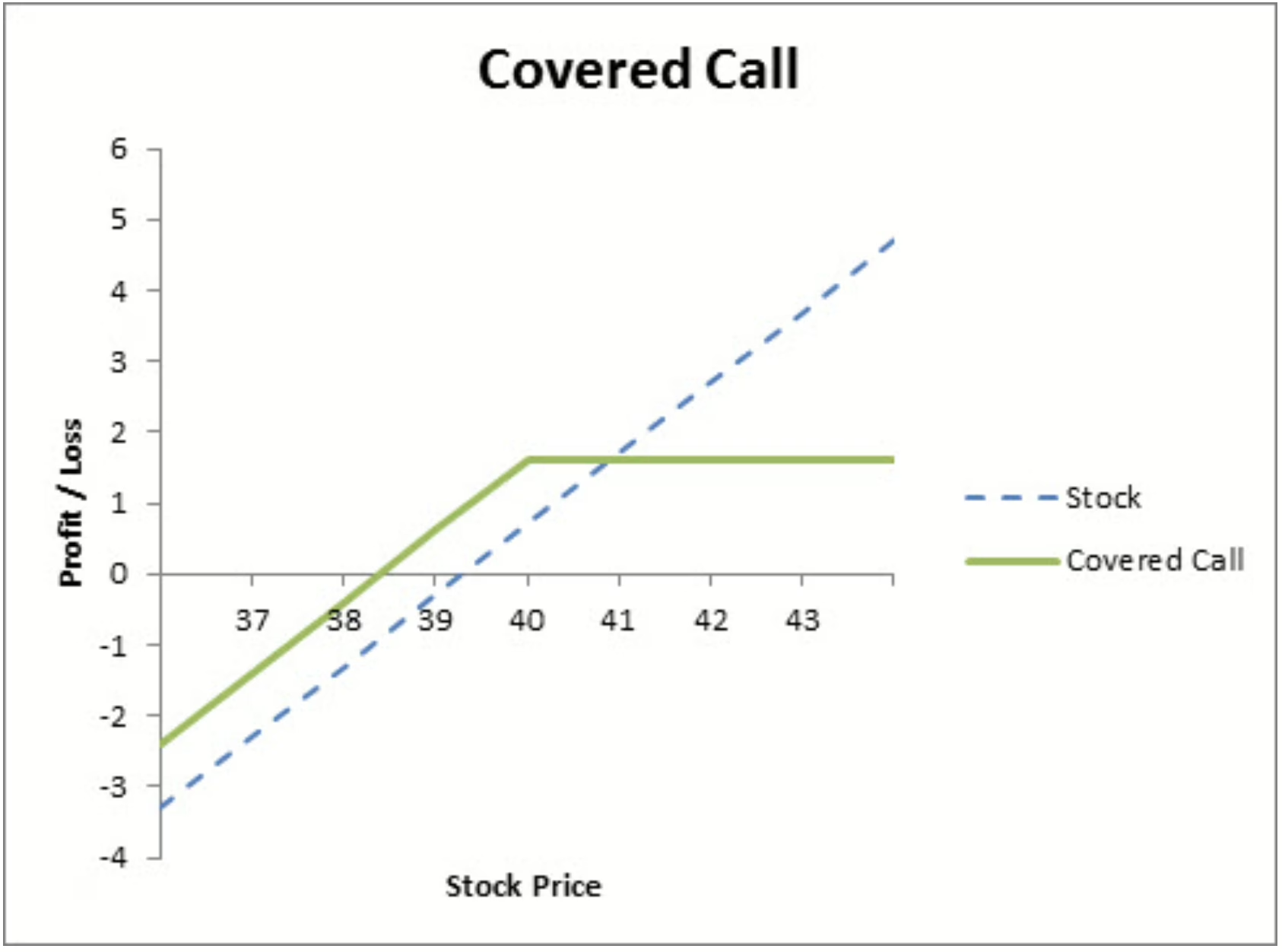

For example, let’s say you own 100 shares of stock XYZ and you want to generate some income from holding the stock. If you bought that stock for $39.3 and then sold a $40 strike price covered call for $0.90 of premium, then the profit/loss chart would be as follows below:

Notice that the breakeven price of the whole strategy is lower due to the premium received from selling the covered call. However the downside to this strategy is if the stock rises in price above the strike price of $40, the shares will be called away and your profit would be capped at the premium times the number of covered calls you sold.

Another very simple and useful strategy is lowering your cost basis on a stock you want to own. If you have enough cash to buy 100 shares of a stock you want to own, then you can sell a cash-secured put. A cash-secured put is where you have the cash to collateralize a potential purchase of 100 shares of the underlying stock. But the best part of this is that your cost basis won’t be the strike price of the sold put, but rather the strike price minus the premium from the sold put. Thus you can effectively lower the cost basis of your 100 shares.

The Greeks & What They Are

So what determines the premiums that each option is worth? Well several factors really, but the concepts are refined and defined into Greek letters. Understanding these Greeks is necessary to understand the price fluctuations of options and to successfully make money from options. Since these are so important, I will be describing them in further detail as I update this article, but for now here are the major concepts.

-

Delta: Measures sensitivity to price changes in the underlying stock.

-

Theta: Measures time decay — how much value the option loses as expiration nears.

-

Gamma: Measures how much delta changes as the stock moves.

-

Vega: Measures sensitivity to changes in implied volatility.

Tips for Beginners

-

Avoid Complex Strategies Early: Stick to simple trades like buying calls or puts until you’re more comfortable.

-

Manage Risk Carefully: Never risk more than you can afford to lose and set stop losses.

-

Understand Volatility: Implied volatility has a huge impact on options pricing.

-

Set Exit Rules: Know in advance when to take profits or cut losses.

-

Keep Learning: Options trading is a skill that improves over time with study and practice.

Conclusion

Options offer powerful ways to enhance your investing strategy, whether you’re looking to speculate, hedge, or generate income. While they can seem intimidating at first, beginning with the basics, practicing in a risk-free environment, and gradually building knowledge will set you on the path to becoming a proficient options trader.

The key is patience, education, and risk management. Start simple, stay curious, and grow your skills over time. I will keep updating this article to keep it providing as much value as possible to my readers.