Retirement often conjures images of newfound freedom, pursuing passions, and savoring the rewards of years of hard work. However, the idyllic vision can only materialize with meticulous financial planning. At the core lies the fundamental practice of saving diligently and strategically. Building a robust retirement nest egg isn’t a sprint; it’s a marathon requiring consistent effort, informed decision-making, and a long-term perspective that spans decades.

This comprehensive article delves deep into the essential “dos” and critical “don’ts” of saving for retirement, providing an in-depth roadmap to help you pave a secure and comfortable path towards your golden years, ensuring those dreams of a fulfilling retirement become a tangible reality. I want to expand on the “do’s” and “dont’s” of such a practice; it’s never too late to start, but starting early helps tremendously.

The Indispensable “Dos” of Saving for Retirement

1. Embrace the Power of Time: Start Saving Early, Regardless of the Amount

The single most impactful factor in building a substantial retirement fund is time. The earlier you initiate your savings journey, the more potent the magic of compounding becomes.

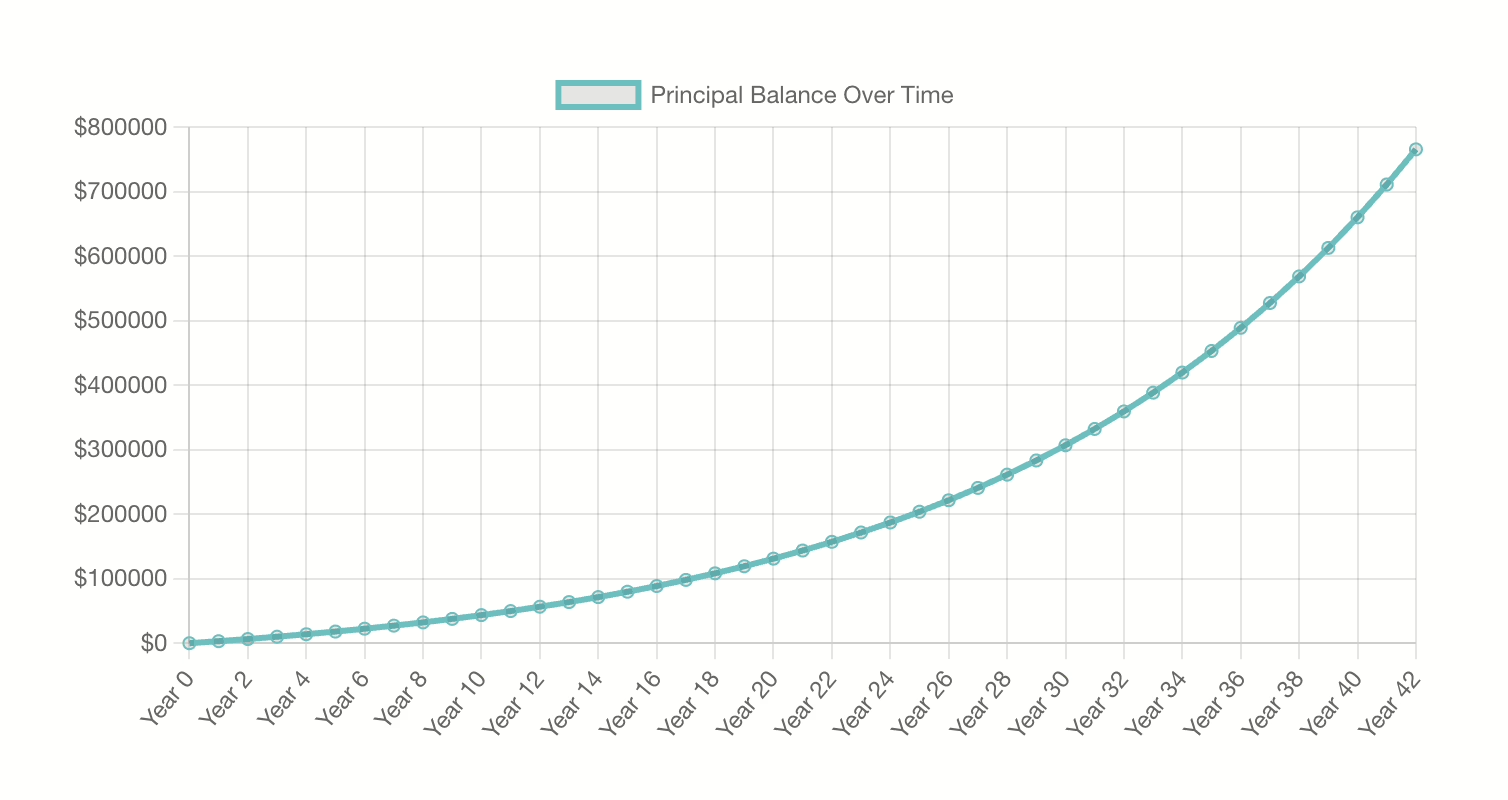

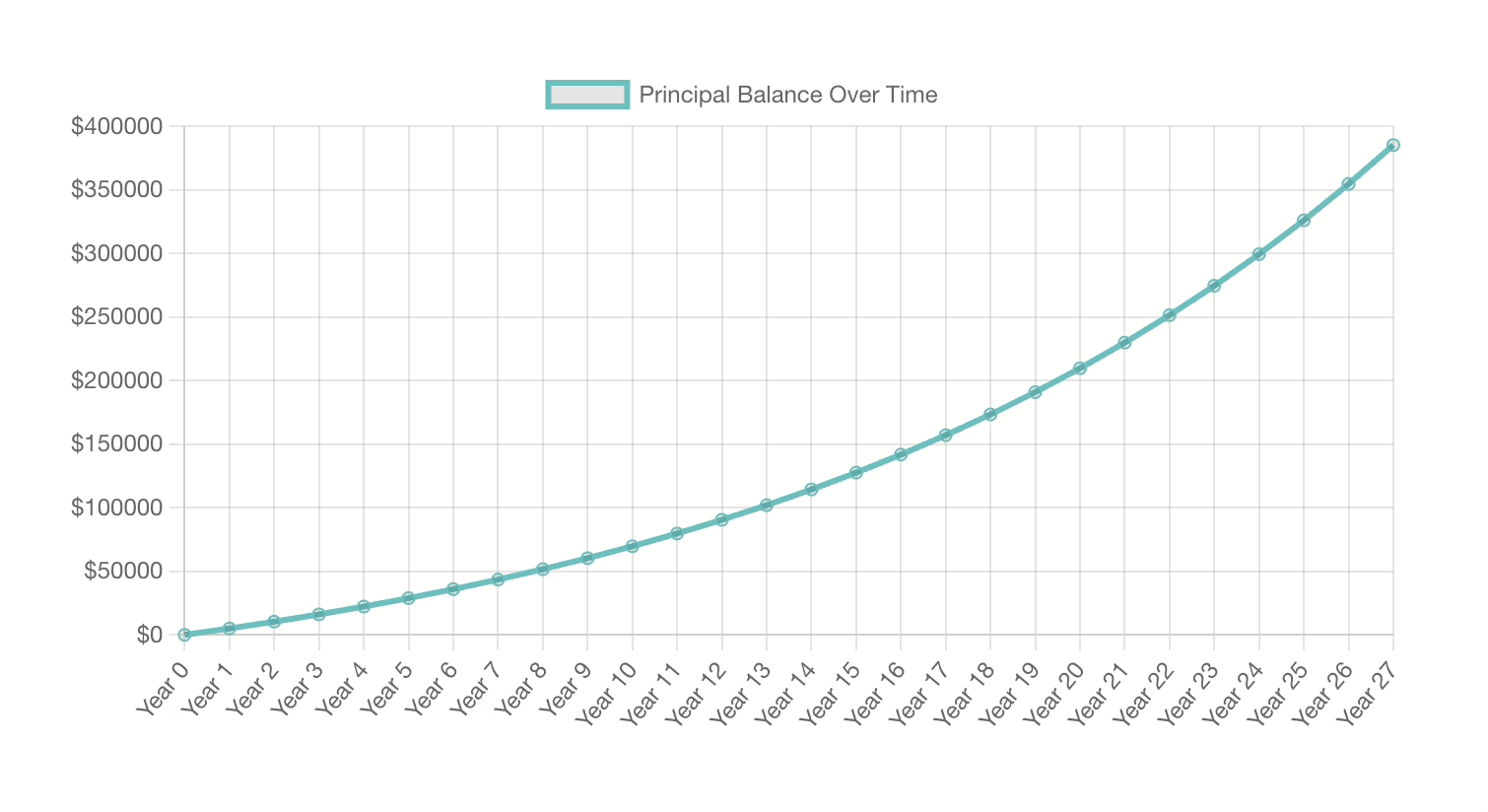

- Harness the Exponential Growth of Compounding: Compound interest, often hailed as the eighth wonder of the world, is the snowball effect of earning returns not only on your initial contributions but also on the accumulated interest. The longer your money has to grow, the more significant the impact of compounding. Even seemingly small contributions made consistently from a young age can blossom into a substantial sum over the decades. For instance, consider two individuals: Person A starts saving $200 per month at age 25, while Person B starts saving $400 per month at age 40 and they both contribute to the age of 67. Assuming an average annual return of 7%, Person A, despite contributing less overall, could potentially have a larger retirement fund due to the extended period of compounding. With my handy dandy compound interest calculator, you can see these results for yourself:

Person A – 25 years old contributing $250 a month till 67 years old

Person B – 40 years old contributing $400 a month till 67 years old

- Don’t Fall into the Trap of “Waiting for the Right Time”: Life is inherently unpredictable, filled with fluctuating income, unexpected expenses, and evolving priorities. The notion of a “perfect” time to begin saving often proves to be an elusive mirage. Don’t let the pursuit of ideal circumstances paralyze you into inaction. Start saving now, even if it’s a modest amount. Look at the examples above as a guiding light. As your financial situation improves, you can incrementally increase your contributions. The crucial element is establishing the habit of saving early and consistently.

2. Chart Your Course: Define Your Retirement Goals and Understand Your Needs

Saving without a clear destination is like sailing without a compass. Understanding your envisioned retirement lifestyle and projecting your future financial needs are paramount for setting meaningful savings targets.

- Paint a Vivid Picture of Your Ideal Retirement: Take the time to truly envision your life post-career. Will you be an avid traveler, exploring new cultures and landscapes? Will you dedicate your time to pursuing expensive hobbies like golf or woodworking? Do you envision downsizing your home or relocating to a different climate? The more detailed your vision, the more accurately you can estimate your future expenses.

- Project Your Anticipated Expenses with Precision: Go beyond the broad strokes and delve into the specifics of your potential retirement costs. Consider essential expenses such as housing (mortgage or rent, property taxes, insurance, maintenance), healthcare (insurance premiums, out-of-pocket costs, potential long-term care), food, transportation, utilities, and personal care. Don’t forget discretionary spending on leisure activities, travel, entertainment, and gifts. Account for the potential impact of inflation, which will erode the purchasing power of your savings over time. Historical inflation rates and projected future trends should be factored into your calculations.

- Establish Realistic and Measurable Savings Goals: Based on your projected expenses and desired lifestyle, calculate the total amount you’ll need to accumulate by retirement age. Online retirement calculators, financial planning software, and consultations with financial advisors can provide valuable insights and help you set achievable savings targets. Express your goals in tangible figures, such as a specific dollar amount or a desired annual income stream in retirement.

- The 4% Rule to Quantify “Your Number”: The 4% rule is a standard in the industry to understand the number you need for retirement. Take your estimated yearly expenses in retirement and divide by 4%. This is how much you need to live for 30 years; if you expect to need $80,000 in retirement, then you should plan to have $2 million saved before you retire. This is not to say that you can’t adjust the percentage based on market conditions, but this will allow you to calculate a baseline for your retirement goal.

3. Capitalize on Employer-Sponsored Retirement Plans: Your Secret Savings Weapon

Employer-sponsored retirement plans, such as 401(k)s, 403(b)s, and others, offer invaluable benefits that can significantly accelerate your retirement savings journey.

- Enroll Immediately and Participate Fully: If your employer offers a retirement savings plan, make it a top priority to enroll as soon as you become eligible. Don’t let inaction or a perceived lack of immediate funds prevent you from participating. The long-term benefits far outweigh any initial adjustments to your budget or lifestyle.

- Maximize the Power of Employer Matching Contributions: Free Money is on the Table: Employer matching is akin to receiving free money. Most employers offer to match a certain percentage of your contributions, up to a specific limit. Contributing at least enough to receive the full employer match is crucial, as it represents a guaranteed return on your investment. Failing to take advantage of this match is essentially leaving significant sums of money unclaimed. Understand the matching formula offered by your employer and strive to contribute accordingly.

- Become an Informed Investor Within Your Plan: Don’t treat your employer-sponsored plan as a black box. Familiarize yourself with the available investment options, which typically range from conservative bond funds to more growth-oriented stock funds. Some retirement plans categorize your goals for the portfolio under conservative or aggressive based on the holdings within. Understand the risk-return profiles of each option and select a portfolio allocation that aligns with your risk tolerance, time horizon, and retirement goals. Don’t hesitate to seek guidance from your work-place plan administrator or a financial advisor if you need help making informed investment decisions.

4. Prioritize Retirement Savings in Your Financial Blueprint: Pay Yourself First

Saving for retirement should not be an afterthought; it should be a fundamental pillar of your financial plan, treated with the same priority as essential expenses. This is key as many people do not feel ready for retirement, where the bars indicate what percentage in each generation feels ready for retirement:

Source: Empower Retirement Readiness Snapshot, 2025.

- Implement the “Pay Yourself First” Principle: Before allocating funds to discretionary spending, prioritize setting aside a portion of your income for retirement savings. Automate contributions directly from your paycheck to your retirement accounts. This ensures consistency and eliminates the temptation to skip savings when funds feel tight.

- Conduct Regular Budget Reviews and Identify Savings Opportunities: Periodically review your budget to identify areas where you can trim unnecessary expenses. Even small reductions in discretionary spending, when consistently redirected to retirement savings, can accumulate significantly over time. Consider whether that daily latte, those frequent takeout meals, or that unused subscription could be contributing to your future financial security instead. If you need an example of the type of growth that you could be missing out on, check out my compound interest calculator, as it shows the potential growth of skipping daily coffees or restaurants every week. Make sure to check my resources often, as I update my resources on personal finance and budgeting.

- Seize Opportunities to Increase Contributions: Whenever you experience a positive change in your financial situation, such as a salary increase, a bonus, or a reduction in debt payments, make it a point to increase your retirement contributions. Treat these windfalls as opportunities to accelerate your progress towards your retirement goals. And believe me, I understand lifestyle creep. I was able to change my mindset from consumption to production and this helped me take these opportunities and super charge them. I was able to triple my retirement holdings in 2 years by changing my mindset, contributing more to meet my employer match and budgeting more.

5. Embrace the Wisdom of Diversification: Don’t Put All Your Eggs in One Basket

Diversifying your investment portfolio across different asset classes is a fundamental principle of risk management that you should not neglect.

- Understand the Concept of Asset Allocation: Asset allocation involves strategically distributing your investments across various asset classes, such as stocks (representing ownership in companies), bonds (representing loans to governments or corporations), and other asset classes like real estate or commodities. Different asset classes tend to perform differently under various economic conditions.

- Mitigate Risk Through Strategic Spreading: By diversifying, you reduce the risk of significant losses if any single asset class underperforms. When one asset class experiences a downturn, others may hold steady or even appreciate, helping to cushion the overall impact on your portfolio.

- Tailor Your Diversification to Your Risk Tolerance and Time Horizon: Younger investors with a longer time horizon can typically afford to take on more risk and may allocate a larger portion of their portfolio to growth-oriented assets like stocks. As you approach retirement, a more conservative allocation with a greater emphasis on bonds may be appropriate to preserve capital.

- Seek Professional Guidance When Needed: If you feel overwhelmed by the complexities of asset allocation and diversification, don’t hesitate to consult with a qualified financial advisor through your work place plan or separately who can help you create a personalized investment strategy tailored to your specific circumstances and goals.

The Critical “Don’ts” of Saving for Retirement

1. Falling Prey to Procrastination: Time Waits for No One

Delaying the initiation of your retirement savings is arguably the most detrimental mistake you can make.

- Don’t Underestimate the Irreversible Loss of Compounding Time: As emphasized earlier, time is the most valuable asset in retirement savings. Every year you delay starting means a year of lost potential for your money to grow exponentially through compounding. The later you start, the larger the contributions you’ll need to make to catch up.

- Don’t Let the Illusion of Youth Lull You into Inaction: Retirement may seem distant when you’re young, but time passes quickly. Establishing the habit of saving early, even in small amounts, sets you on the right path and allows compounding to work its magic over the long term.

2. Neglecting “Free Money”: Always Maximize Employer Matching Contributions

Forgoing employer matching contributions is akin to voluntarily reducing your compensation.

- Don’t Contribute Less Than the Amount Needed for the Full Match: As highlighted previously, employer matching is a guaranteed return on your investment. Failing to contribute enough to receive the full match means leaving substantial “free money” on the table, hindering your retirement savings progress.

3. Raiding Your Retirement Funds Prematurely: Resist the Urge to Tap In

Treat your retirement accounts as sacrosanct, reserved for their intended purpose – your financial security net in retirement.

- Understand the Severe Penalties and Tax Implications of Early Withdrawals: Withdrawing funds from retirement accounts before reaching the designated retirement age typically triggers significant penalties imposed by the government, in addition to the regular income taxes you’ll owe on the withdrawn amount. These penalties can severely erode your accumulated savings and derail your retirement plans.

- View Retirement Funds as Long-Term Investments, Not Emergency Funds: While unforeseen financial emergencies can arise, it’s crucial to establish a separate emergency fund in readily accessible, liquid accounts (like a high-yield savings account) to cover unexpected expenses without jeopardizing your long-term retirement security.

- Consider Different Options such as Retirement Loans if You Absolutely Need Money: Life happens and sometimes you are between a rock and a hard place. If you have no other options, you can take out retirement loans instead of withdrawing to prevent unnecessary tax penalties. This money will have to be paid back with interest of course, but it may be a last-ditch effort if you need money.

4. Being Excessively Conservative, Especially in Your Younger Years

While preserving capital is important, particularly as you approach retirement, being overly conservative in your early career can stifle potential growth.

- Recognize the Historical Performance of Different Asset Classes: Over the long term, growth-oriented assets like stocks have historically delivered higher average returns compared to more conservative investments like bonds, although with greater short-term volatility.

- Understand the Importance of Outpacing Inflation: Your retirement savings need to grow at a rate that exceeds inflation to maintain their purchasing power over time. Historically, equities have offered a greater potential to outpace inflation compared to fixed-income investments.

- Consider a Risk-Appropriate Asset Allocation Based on Your Time Horizon: Younger investors with a longer time horizon have more time to recover from market downturns and can typically afford to take on more risk in pursuit of higher potential returns. As you age and your retirement horizon shortens, gradually shifting towards a more conservative allocation may become appropriate.

5. Overlooking the Silent Thief: Always Account for Inflation

Inflation, the gradual increase in the cost of goods and services, can significantly erode the purchasing power of your savings over time.

- Factor Inflation into Your Retirement Savings Projections: When estimating your future retirement expenses and savings goals, it’s crucial to account for the impact of inflation. What seems like a comfortable sum today may have significantly less purchasing power several decades from now.

- Consider Investments with the Potential to Outpace Inflation: Certain asset classes, such as stocks and inflation-protected securities (TIPS), have historically demonstrated the ability to outpace inflation over the long term, helping to preserve the real value of your retirement savings. For younger and more risk-inclined investors, even allocating small portions to Bitcoin may be an interesting idea to diversify and outpace inflation even further.

6. Setting It and Forget It: Regularly Review and Adjust Your Savings Plan

Your financial circumstances, retirement goals, and the economic landscape are not static. Your retirement savings plan should be a dynamic document that you review and adjust periodically.

- Conduct Annual Reviews of Your Progress: At least once a year, take a comprehensive look at your retirement savings progress. Assess whether you are on track to meet your goals based on your current contributions and investment performance.

- Adapt to Life Changes and Financial Shifts: Major life events, such as changes in income, marriage, the birth of children, or significant expenses, can impact your ability to save. Adjust your contributions and savings strategy accordingly to stay on track.

- Rebalance Your Portfolio to Maintain Your Desired Asset Allocation: Over time, the performance of different asset classes in your portfolio will likely vary, causing your initial asset allocation to drift. Rebalancing involves selling some assets and buying others to bring your portfolio back in line with your target allocation, helping to manage risk and maintain your long-term investment strategy.

Conclusion: Paving the Path to a Secure Future

Saving for retirement is not merely about accumulating a sum of money; it’s about laying the foundation for a future filled with financial security, independence, and the freedom to embrace your passions. By diligently adhering to the “dos” of starting early, defining your goals, maximizing employer benefits, prioritizing savings, and diversifying wisely, you empower yourself to build a robust retirement nest egg.

Conversely, by consciously avoiding the “don’ts” of procrastination, neglecting free money, making early withdrawals, being overly conservative early on, ignoring inflation, and failing to review your plan, you can steer clear of common pitfalls that can derail your retirement dreams.

Remember that the journey to a comfortable retirement is a marathon of consistent effort and informed decisions. Start saving today, stay disciplined in your approach, and let the power of time and compounding work in your favor, ensuring your golden years truly shine. I believe in you.

Disclosure: This is not intended as financial advice to buy or sell any asset or investment.