In this article, I analyze three stocks – Warrior Met Coal (NYSE: HCC), ASML Holding (NASDAQ: ASML), and Fair Isaac Corporation (NYSE: FICO).

These stocks caught my eye for a number of reasons. I looked at their financials, business models, competitive advantages, and potential risks to find out if they could be good long-term investments for my public account as well as provide you some potential investments after you do your due diligence of course.

Fair Isaac Corporation (FICO)

Business Overview: Fair Isaac Corporation, widely known as FICO, is a data analytics company focused on credit scoring and decision management software. Their FICO Score is the industry standard for assessing consumer credit risk in the United States and is used extensively by lenders to make credit-granting decisions. This tri-merge system combines Equifax, Transunion and Experian to produce a final credit score for lenders. However this may soon be disrupted into a bi-merge system leading to lower volumes and revenue. The company operates through two main revenue-generating segments: Scores, which includes its business-to-business scoring solutions and business-to-consumer myFICO services; and Software, which provides advanced analytic and digital decisioning technology solutions for areas like fraud, marketing, and customer management.

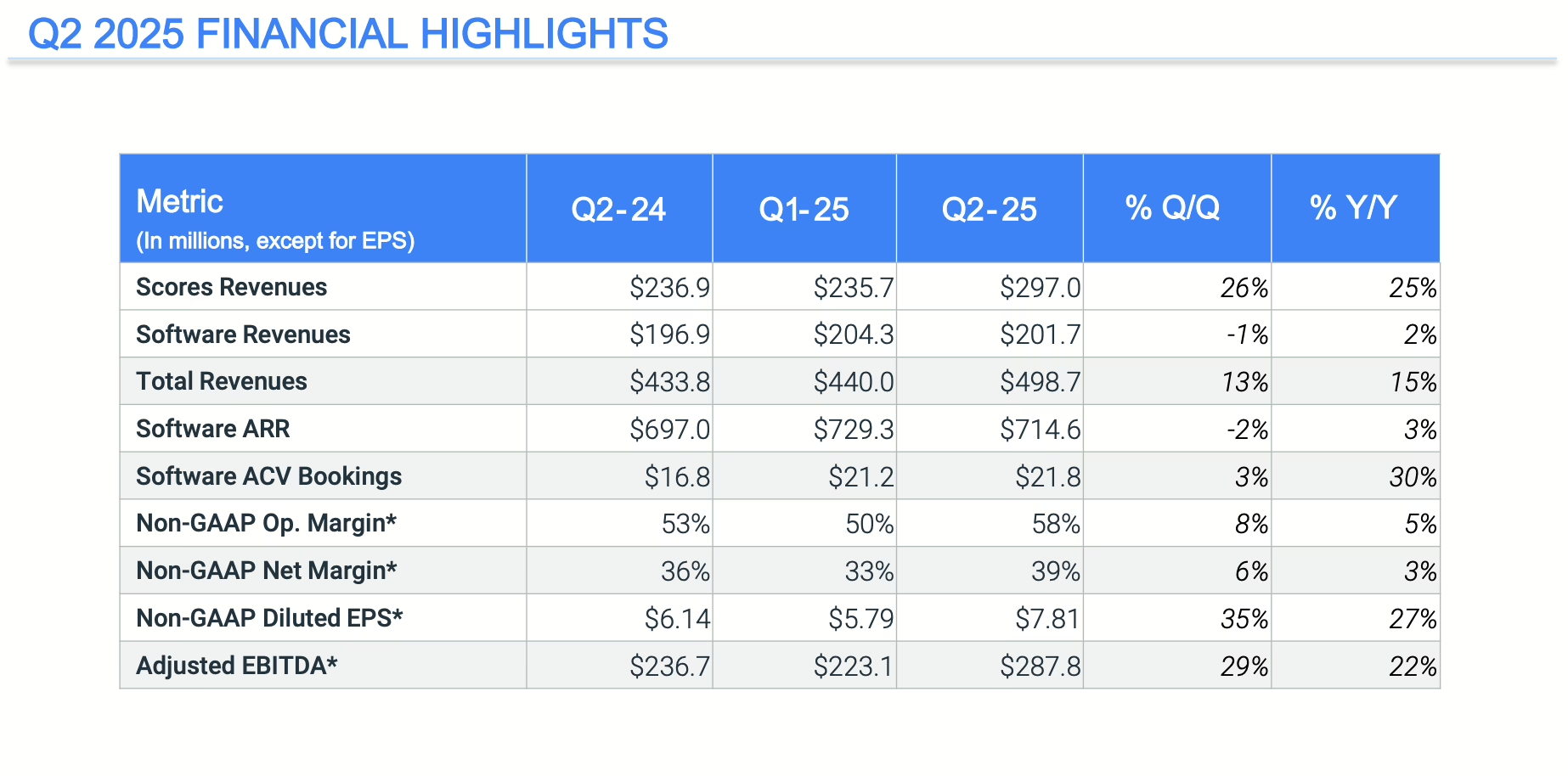

FICO Q2’25 Financial Highlights

Financial Snapshot & Analysis: FICO has a track record of consistent revenue and earnings growth. For its second fiscal quarter of 2025 (ended March 31, 2025), FICO reported revenues of $498.7 million, a 15% increase year-over-year. GAAP net income was $162.6 million, or $6.59 per share, while non-GAAP net income stood at $192.7 million, or $7.81 per share. The Scores segment saw a 25% revenue increase, driven largely by higher unit prices for B2B scoring and a 6% rise in B2C revenue. The Software segment grew by 2%, with Software Annual Recurring Revenue (ARR) up 3% year-over-year. FICO reiterated its fiscal year 2025 guidance, projecting double-digit percentage growth for both revenue and earnings. The company typically generates strong free cash flow. However, it currently trades at a high P/E ratio, reflecting market confidence in its continued growth and market position.

Industry Dynamics: The credit scoring and financial analytics industry is critical to the functioning of credit markets. It is currently experiencing evolution driven by advancements in financial technology (fintech), big data, artificial intelligence (AI), and machine learning (ML). There is a growing trend towards using alternative data sources to assess creditworthiness, particularly for “thin-file” or unbanked individuals. This does mean that the credit score market could experience an upswing in competition and variety. Regulatory scrutiny regarding fairness, transparency, and potential bias in credit scoring models is also a significant factor.

Moats and Competitive Advantages:

- Brand Recognition and Incumbency (FICO Score): The FICO Score is deeply embedded in the U.S. financial system. Lenders have relied on it for decades, creating enormous inertia and high switching costs. Regulatory acceptance and widespread consumer understanding further solidify its position.

- Network Effects: The widespread adoption of the FICO Score by lenders incentivizes consumers to monitor and improve their FICO Scores, which in turn reinforces it’s value to lenders.

- Predictive Power and Data Analytics Expertise: FICO has decades of historical data and refined analytical models that provide strong predictive capabilities regarding consumer credit risk.

- Growing Software Business: FICO is expanding its software solutions, leveraging it’s analytical expertise to help businesses make better decisions across various functions, providing diversification and growth beyond credit scores.

Potential Disruptors:

- Alternative Credit Scoring Models and Data: Fintech companies and even some large lenders are exploring and using alternative data (e.g., rent payments, utility bills, educational background, digital footprint) and AI/ML algorithms to create more inclusive or supposedly more predictive credit scores. This could erode FICO’s dominance over time.

- Regulatory Pressure and Changes: Increased regulatory scrutiny on credit scoring practices, including pricing and the types of data used, could lead to changes that impact FICO’s business model or profitability. Recent comments from federal housing officials regarding the cost of credit evaluations have put some pressure on the stock.

- Consortiums or New Industry Standards: Lenders could potentially collaborate to develop or adopt alternative scoring standards, although this would be a complex and lengthy undertaking.

- Technological Disruption: Advances in AI and ML could enable new entrants to develop highly predictive models, although FICO is also investing heavily in these areas.

Compelling Investment Thesis: FICO’s entrenched position in the U.S. credit market, driven by the ubiquity of the FICO Score, provides a strong economic moat. Their consistent revenue growth, high-profit margins, and robust free cash flow generation are attractive. The high switching costs associated with moving away from the FICO Score have provided a significant buffer for years. However, competition and score system changes may derail some of that consistency that FICO has enjoyed over the years.

Warrior Met Coal (HCC)

Business Overview: Warrior Met Coal is a U.S.-based, pure-play producer and exporter of high-quality metallurgical (met) coal, an essential ingredient in the global steel-making process. Operating two underground mines in Alabama, the company is known for producing premium hard coking coal (HCC, i.e. their ticker namesake) characterized by it’s low volatility and high coke strength, which commands premium pricing in the coal market. They primarily market their coal to European and South American steel producers.

Financial Snapshot & Analysis: Warrior’s financial performance is inherently tied to the cyclical nature of the global steel and met coal markets. In it’s most recent earnings report for the first quarter of 2025 (ended March 31, 2025), the company reported a net loss of $8.2 million, or $0.16 per diluted share, a significant decrease from the net income of $137.0 million, or $2.62 per diluted share, in the first quarter of 2024. Total revenues for Q1 2025 were $299.9 million, down from $503.5 million in the prior-year period.

These declines was largely attributed to substantially weaker met coal market conditions, with a 40% lower index price for premium low-vol steelmaking coal year-over-year. Despite the recent downturn in coal prices, Warrior has focused on cost management. Cash cost of sales (free-on-board port) per short ton decreased to $112.35 in Q1 2025 from $133.48 in Q1 2024, primarily due to lower variable costs linked to coal prices. In addition, Warrior is building out their Blue Creek mine project which will expand their production immensely and put them in the league of Alpha Metallurgical Resources (AMR) in terms of scale of production of met coal.

As of the latest quarter, the company maintained a net cash position, indicating a degree of financial resilience.

Industry Dynamics: The metallurgical coal industry is global and subject to price volatility influenced by steel demand, global economic growth (particularly in industrial and construction sectors), supply disruptions, and evolving trade policies. While demand for steel remains robust, especially with ongoing infrastructure development and urbanization in emerging economies such as India, the industry faces increasing scrutiny due to environmental, social, and governance (ESG) concerns. However, this political administration may be more favorable to Warrior’s industry and the company itself.

Moats and Competitive Advantages:

- High-Quality Reserves: Warrior’s access to and production of premium-grade met coal is a key advantage, as these grades are essential for efficient blast furnace operations and are not easily substitutable.

- Established Infrastructure and Export Access: Their operations are supported by established mining infrastructure and access to export terminals, facilitating global trade.

- Low on the Cost Curve: Warrior is an extremely low-cost coal producer relative to their peers in the industry which allows them to survive in low coal prices times such as now.

- Blue Creek Growth Project: The development of the Blue Creek mine represents a significant future growth catalyst, poised to tap into new reserves of high-quality coal.

Potential Disruptors:

- ESG Concerns and Decarbonization: The global push towards decarbonization and stricter environmental regulations pose a long-term threat to coal demand. Steel producers are exploring greener steel-making technologies (e.g., hydrogen-based) that could reduce or eliminate the need for met coal.

- Price Volatility: The inherent cyclicality of met coal prices can significantly impact Warrior’s revenues and profitability.

- Geopolitical Risks and Trade Policies: Changes in international trade relations and tariffs can affect export volumes and realized prices.

- Operational Risks: Underground mining carries inherent operational risks, including safety and geological challenges. In addition, even though the Blue Creek mine is almost complete, any disruption in the schedule could materially affect stock price.

Compelling Investment Thesis: Despite the current met coal market softness, Warrior can be a compelling investment for those with a long term view and no problem with a cyclical industry. They are well-positioned to benefit from a perfect storm of conditions – rising demand from emerging economies, falling global supply and increasing their own production.

ASML Holding (ASML)

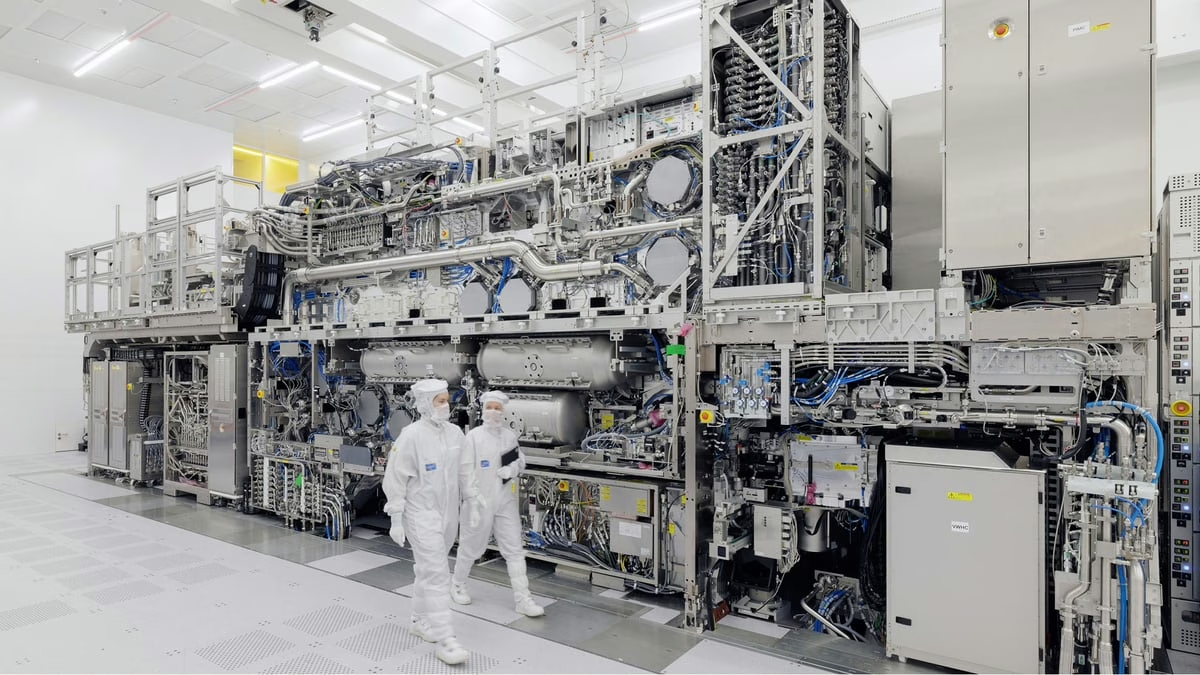

Business Overview: ASML Holding is a Dutch multinational corporation and the world’s leading supplier of photolithography systems for the semiconductor industry. These systems are critical in the production of integrated circuits (ICs), or chips. ASML designs, develops, manufactures, and services advanced lithography systems, with its Extreme Ultraviolet (EUV) lithography machines being indispensable for manufacturing the most advanced processors and memory chips. Their customers include all of the world’s leading chipmakers.

Financial Snapshot & Analysis: ASML has demonstrated robust financial growth, driven by the relentless demand for more powerful and efficient semiconductors. In their first-quarter 2025 results (ended March 30, 2025), ASML reported total net sales of €7.7 billion and a net income of €2.4 billion. The gross margin for the quarter was strong at 54.0%. While quarterly net bookings were €3.9 billion (of which €1.2 billion was for EUV systems), down from the previous quarter, the company reiterated its expectation for 2025 and 2026 to be growth years, largely fueled by the AI-driven demand. ASML projects 2025 total net sales to be between €30 billion and €35 billion with a gross margin between 51% and 53%. Importantly, they maintain a significant order backlog which provides visibility into future revenues.

Industry Dynamics: The semiconductor equipment industry is characterized by high innovation, significant R&D investment, and cyclicality tied to semiconductor demand. Key growth drivers include the proliferation of artificial intelligence, high-performance computing, 5G, IoT, and automotive electronics. The industry is also subject to geopolitical tensions, particularly concerning technology access and supply chain sovereignty.

Moats and Competitive Advantages:

- Monopoly in EUV Lithography: ASML is the sole global supplier of EUV lithography systems, which are essential for producing chips at 7nm nodes and below. This technological monopoly creates an unparalleled competitive advantage and high barriers to entry.

- Deep R&D and Innovation: The company invests heavily in research and development, continuously pushing the boundaries of lithography technology (e.g., High-NA EUV). This relentless innovation keeps it ahead of any potential competition. They are significantly ahead of any competition and have are continuing to think of technology advancements years into the future.

- Strong Customer Relationships: ASML works closely with the world’s largest chipmakers (like TSMC, Samsung, and Intel), fostering deep, long-term partnerships.

- High Switching Costs: The complexity, cost, and integration of lithography systems into a semiconductor fabrication plant (fab) result in extremely high switching costs for their customers.

- Installed Base Management: A significant and growing portion of ASML’s revenue comes from servicing and upgrading their large installed base of systems, providing a recurring revenue stream.

Potential Disruptors:

- Geopolitical Tensions: Export controls and restrictions, particularly related to China, can impact ASML’s sales and the broader semiconductor supply chain. Trade wars and national security concerns could lead to market fragmentation.

- Technological Breakthrough by a Competitor (Highly Unlikely in the Medium Term): While ASML’s lead is substantial, the theoretical possibility of a disruptive new patterning technology emerging from a competitor always exists, though the R&D and capital hurdles are immense.

- Cyclicality of the Semiconductor Industry: While long-term trends are positive, the semiconductor industry is prone to cyclical downturns that can temporarily impact equipment demand.

- Supply Chain Constraints: The complexity of ASML’s systems relies on a sophisticated global supply chain, which can be vulnerable to disruptions.

Compelling Investment Thesis: ASML represents a monopolistic position in EUV lithography which is critical for the production of the most advanced chips. This is one of the strongest competitive advantages or moats I have seen in the market. The long-term structural growth drivers for semiconductors, particularly AI and high-performance computing, directly translate into sustained demand for ASML’s systems. The company’s significant R&D investment ensures it remains at the forefront of technological innovation.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. You should consult with a qualified financial advisor before making any investment decisions.